Card payments

Overview

Swan offers Mastercard debit cards to all of your account members. Swan cards are accepted everywhere Mastercard is accepted, though there can be risk-based restrictions imposed in certain situations. Mastercard's exchange rate applies to card transactions outside of SEPA.

Individual account holders are issued consumer debit cards, while company account holders receive business debit cards. The fee per card depends on your contract with Swan and is detailed in your Swan Terms and Conditions. Note that cards don't come with insurance.

Refer to the general cards section for information about designing and issuing cards, as well as explanations of how virtual, physical, and digital cards work at Swan.

Card transactions

Each card transaction object contains specific payment data in the CardTransaction interface, including:

- Terminal ID: unique identifier of the merchant's terminal in the Mastercard network

- Merchant ID: unique identifier of the merchant in the Mastercard network

- Merchant name

- Merchant city

- Merchant postal code

- Merchant Category Code (MCC)

- Original amount and currency

Some physical card terminals in the Netherlands refuse Mastercard transactions. Therefore, Swan offers a Maestro fallback for qualified physical cards.

If the fallback is used to complete a transaction, the API returns the masked Maestro card information when queried for transaction details. The masked information also appears in the transaction history on your Dashboard and Swan's Web Banking interface.

Card transaction statuses

There's a close link between transaction statuses and account balances. Refer to explanations of types of account balances in the accounts section.

| Card transaction status | Explanation |

|---|---|

Pending | Card payments initiated with an authorization granted. The payments aren't debited from the account yet, but they impact the account's Pending balance.Next steps:

|

Booked | Completed card payments that are displayed on the official account statement. These card payments have been debited from the account, and they impact the account's Booked balance. |

Released | Card authorizations are released for specific reasons. Most of the time, the funds are captured when the merchant requests the actual debit. Authorizations might also be released by the merchant, and they can expire. When an authorization is released without a debit (clearing), the account's available balance increases by the amount of the authorization. |

Rejected | Declined or refused card payments. For example, you, Swan, Mastercard rejected authorization for the payment, or the account's Available balance isn't sufficient to complete the card payment without resulting in a negative balance. |

Fraud and card transactions

When a cardholder is a victim of fraud, they must declare it to Swan.

If, after an internal investigation, the chargeback is admissible, Swan creates a new InternalCreditTransferIn credit transaction with the status Booked, which impacts the account's booked balance.

The chargeback transaction is linked to the same payment as the initial card transaction.

At the slightest suspicion of fraud, block all eCommerce payments temporarily by updating eCommerce to false for the concerned card product.

Additionally, you can temporarily or permanently block physical cards and permanently cancel virtual cards.

The cardholder then needs to submit a support request, after which Swan can issue a new card.

International card transactions

In order for your cardholders to make international card transactions, configure the card settings to allow them.

For a smoother user experience, both international and nonMainCurrencyTransactions should be activated.

Unless your Terms and Conditions state differently, a 2% fee applies to international card transactions. Note that Mastercard's exchange rate applies to card transactions outside of SEPA.

Authorization and clearing

Processing card payments involves two key steps:

- Getting authorization for an initiated payment.

- After some time, clearing that payment.

Authorization

When a Swan cardholder initiates a payment, the merchant asks Swan, as well as Mastercard, for a payment authorization. An authorization is permission from the cardholder's issuing institution to debit the account. For example, they might ask Swan to check that the cardholder has enough money to cover the purchase.

Authorizations occur predominantly online, requiring the merchant to be connected to the internet and card network. Offline authorizations can be accepted in certain circumstances. All linked card transactions (authorizations, debits, refunds, and chargebacks) have the same Payment ID.

Authorization transactions

Any time an authorization is requested, a CardOutAuthorization transaction is created.

Swan shares the authorization decision with you through payment control.

Therefore, the Partner (you), Swan, and Mastercard all work together to accept (authorize) or reject all card transactions.

When an authorization is accepted by Swan, Mastercard, and you, the transaction is created with the status Pending.

The account's Available balance and the card's spending limit are updated accordingly.

If an authorization is refused by Swan, Mastercard, or you, the transaction is created with the status Rejected.

The reasonCode explains why the authorization was refused.

Expiration

Authorizations are valid for a set amount of time.

At Swan, an authorization's validity period is between 10 and 30 days depending on the type of card transaction.

After the validity period, the balance that hasn't been debited is Released and the card's spending limit updated accordingly.

Find an authorization's expiry date with the pendingEndDate attribute of the PendingTransactionStatusInfo object.

Offline authorizations

It's possible that a physical or in-person point of sale can't complete online authorizations. For example, some situations in which online authorizations might not work include paying at parking kiosks or toll booths, making purchases while on an airplane or other mode of travel, and network failure. In these situations, a Swan cardholder can still initiate many payments.

Partial authorizations

Consider the gas station example.

When a cardholder inserts their card into the gas station's point of sale, the gas station requests a preauthorization of 110€.

However, if the Swan account's Available balance is only 55€, Swan can accept a partial authorization for just 55€.

Clearing

After authorization, or when the merchant gets back online in the case of offline authorizations, the payment goes through clearing. During clearing,the payment is processed and the funds are transferred from the cardholder's account to the merchant's account.

Clearing usually occurs one to three days after the authorization, depending on the merchant. The process is not absolute, however, so make sure to review the examples section for several situational flows. For example, all of the following can exist: authorizations without debit, debits without authorizations, and multiple debits for the same authorization.

Partial and exceeding debits

In situations where only part of an authorized amount is debited (for example, when only part of an order can be fulfilled), Swan updates the initial transaction to reflect the reduced Pending amount.

Users can have several partial debits (consider the online shopping example).

If the debit amount exceeds the amount initially authorized, Swan links both transactions under the same payment to ensure accurate accounting and tracking. This also applies if a debit occurs after the authorization expires.

Initiating a debit transaction

When a merchant requests debit on a card, Swan receives the information asynchronously and creates a new CardOutDebit transaction with the status Booked.

This transaction impacts the account's Booked balance.

When a debit transaction is linked to an authorization, the corresponding Pending CardOutAuthorization transaction is updated with the remaining amount to be debited, and the card's spending limit is updated accordingly.

If the updated authorization amount is equal to or less than zero, the status changes to Released; otherwise, the status remains Pending.

Cardholders can ask Swan to release the authorized amount early with proper documentation. Share the Swan Support Center article to guide them through the process.

Clearing a credit transaction

When a merchant requests credit on a card, Swan receives the information asynchronously and creates a new CardOutCredit transaction with the status Booked.

This transaction impacts the account's Booked balance.

If the credit request is to reverse a previous debit transaction, a new CardOutDebitReversal transaction is created linked to the original debit payment.

Capture types

Capture refers to the process of completing a transaction and moving the funds from the customer's account to the merchant's account after authorization. At Swan, you might encounter various capture types, including those described in the following table.

| Capture type | Explanation | Example |

|---|---|---|

| Standard capture | The merchant captures the authorized amount. | A customer authorizes a 70€ purchase, and the merchant captures 70€. |

| Over capture | The merchant attempts to take more funds from the customer than the original authorization amount. | The cardholder makes a transaction for $100 USD. Therefore, the authorized amount is 100€ EUR. Currency exchange fluctuates, so the merchant captures 110€ instead of 100€. |

| Forced capture | The merchant forces a transaction without the authorization code from the card issuer. Merchants might attempt forced capture if they don't receive a response from the card issuer. | The merchant doesn't receive authorization for a 15€ in-flight purchase, but processes the capture anyway. |

| Late capture | The merchant captures a transaction after the authorization expires. This is a type of forced capture. | The merchant captures a 35€ transaction 12 days after the transaction was made. The transaction authorization expired, but the merchant captures the 35€ anyway. |

| Partial capture | The merchant only captures a portion of the authorized amount. | A customer purchases 400€ worth of goods online, but some items are on back order. The merchant only captures 300€, the amount for the goods they actually shipped to the customer. The 100€ remains in Pending. |

Examples

Some merchants don't follow the classic authorization and debit payment flow. Discover alternative payment flows that work for different use cases. These are examples, not rules; merchants control their own flows and can makes changes at any time.

- 🚗

- ⛽

- 📦

- 📤

- 🏪

- ❌

- 🏨

- ✈️

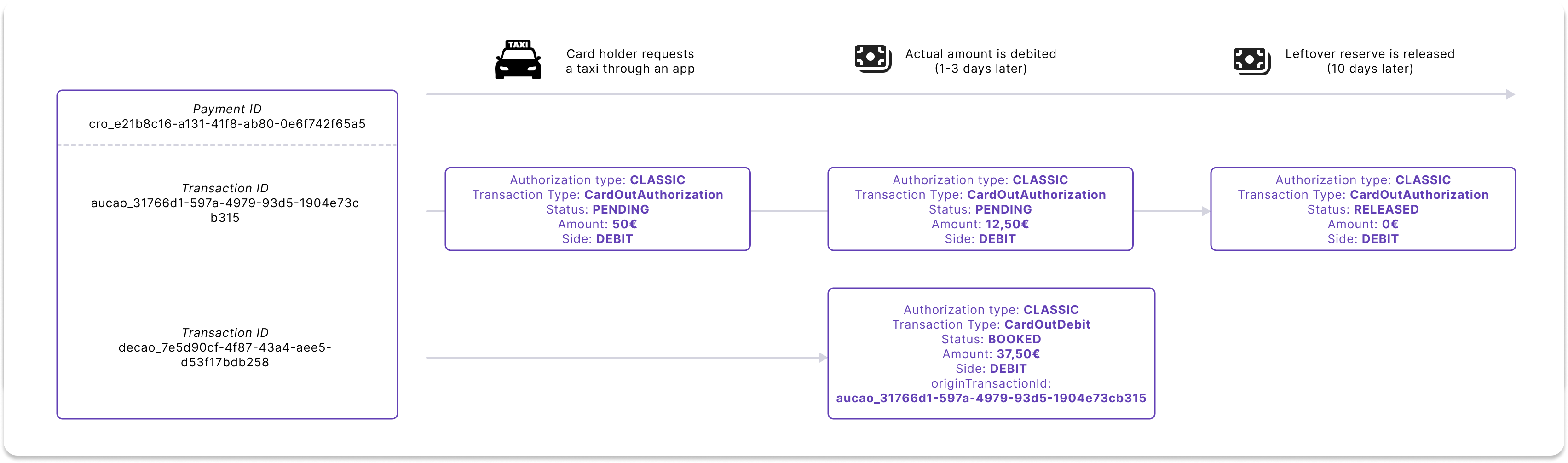

Taxi | Authorization + partial debit clearing

Sometimes, a merchant authorizes a default amount, then debits the real amount later.

Consider a cardholder using a taxi app:

- The cardholder orders a taxi on the app.

- The merchant requests an authorization of 50€ to verify that the cardholder can cover the cost of the trip.

- About 1-3 days after the trip:

- The taxi company debits the account 37,50€, creating a second transaction with the status

Booked. - The remainder of the total authorized amount after the

Bookedtransaction is 12,50€.

- The taxi company debits the account 37,50€, creating a second transaction with the status

- 10 days after the trip, the remaining authorization amount is released.

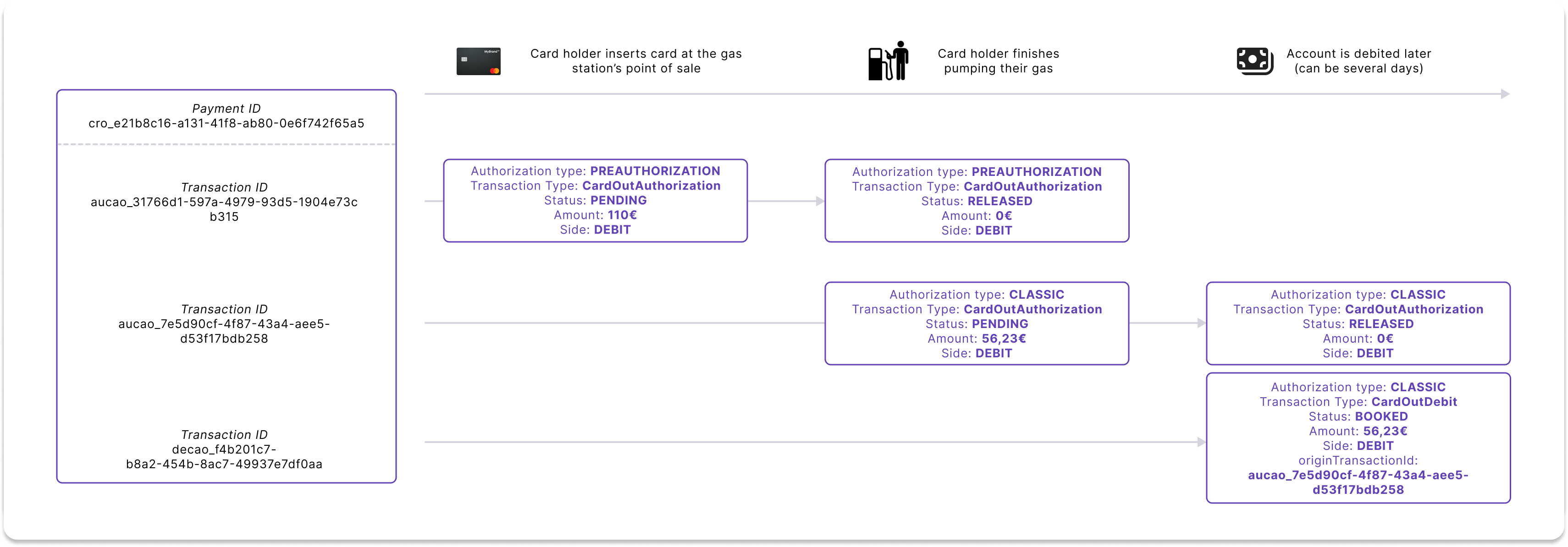

Gas station | Preauthorization + authorization + debit clearing

Automated fuel dispensers make a preauthorization request to check if the card is valid and has enough money.

Consider a cardholder filling up their gas tank:

- The cardholder enters their card in the gas station's point of sale.

- The merchant requests a preauthorization of 110€.

- The cardholder fills their vehicle.

- The merchant authorizes the exact amount (56,23€) that was used and releases the preauthorization.

- A few days later, the merchant debits the account the exact amount (56,23€) and the authorization is released.

This flow can also be used for hotel bookings that are made in advance, but not paid for until after the stay is over.

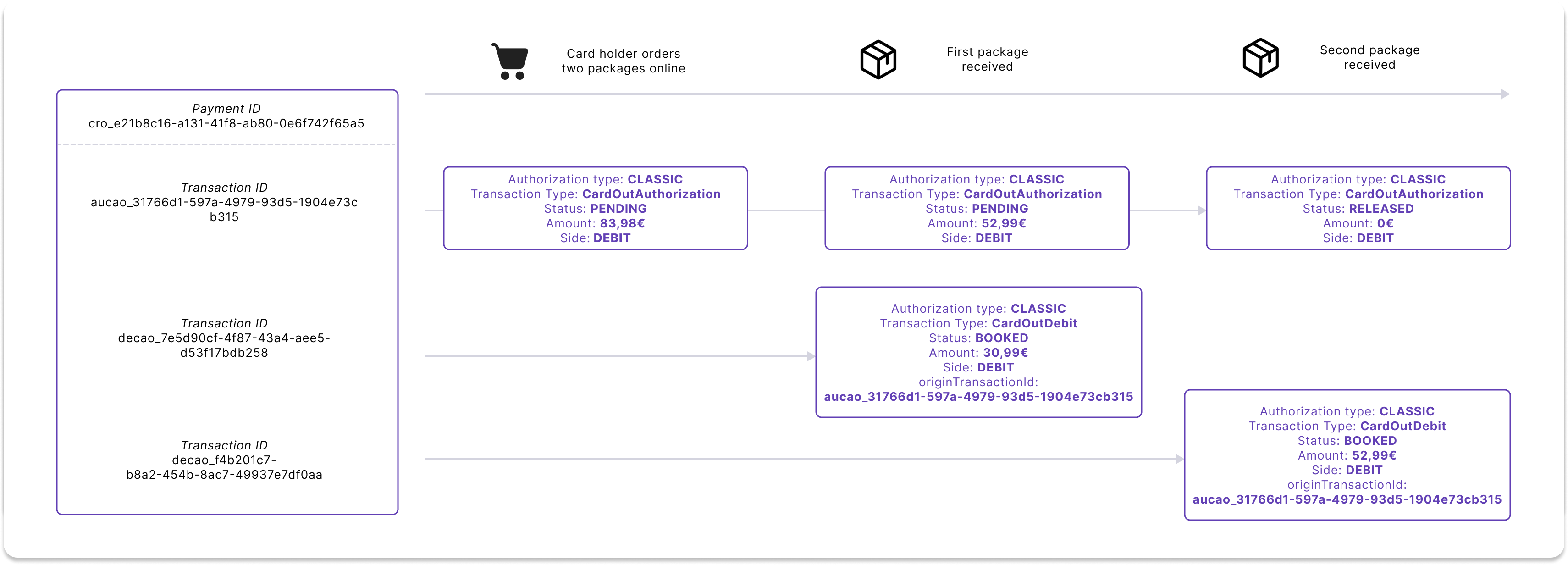

Online shopping | Multiple debit authorizations + debit clearing

When ordering multiple packages online from a reseller-type website, it's common to authorize multiple debits at once.

Consider a cardholder ordering two items fulfilled by different sellers:

- The cardholder orders two packages online.

- The merchant requests an authorization for the total amount (83,98€).

- The merchant debits the amount corresponding to the first package (30,99€) when the cardholder receives the package, which updates the authorization.

- The merchant debits the remaining amount (52,99€) when the second package is received. The authorization goes to 0€ and is released.

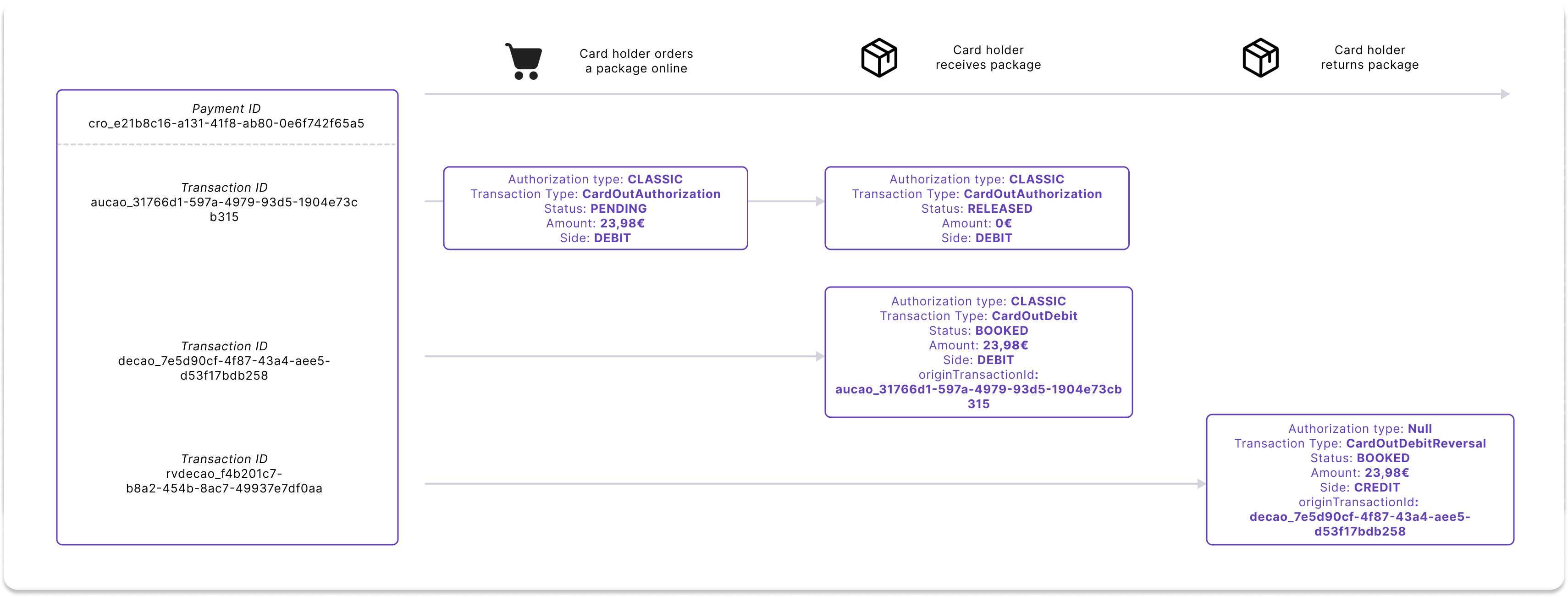

Online return | Authorization + debit clearing + refund

There are multiple ways to reimburse a payment. The most straightforward is for the merchant the refund the debit transaction (debit reversal). The merchant must be able to link the refund to the debit.

Consider a cardholder who orders and returns a package, all online:

- The cardholder orders a package online.

- The merchant requests an authorization for the amount (23,98€).

- When the cardholder receives the package, the merchant debits the account the amount (23,98€) and the authorization is released.

- The cardholder returns the package, and the merchant reverses the debit on the account (23,98€).

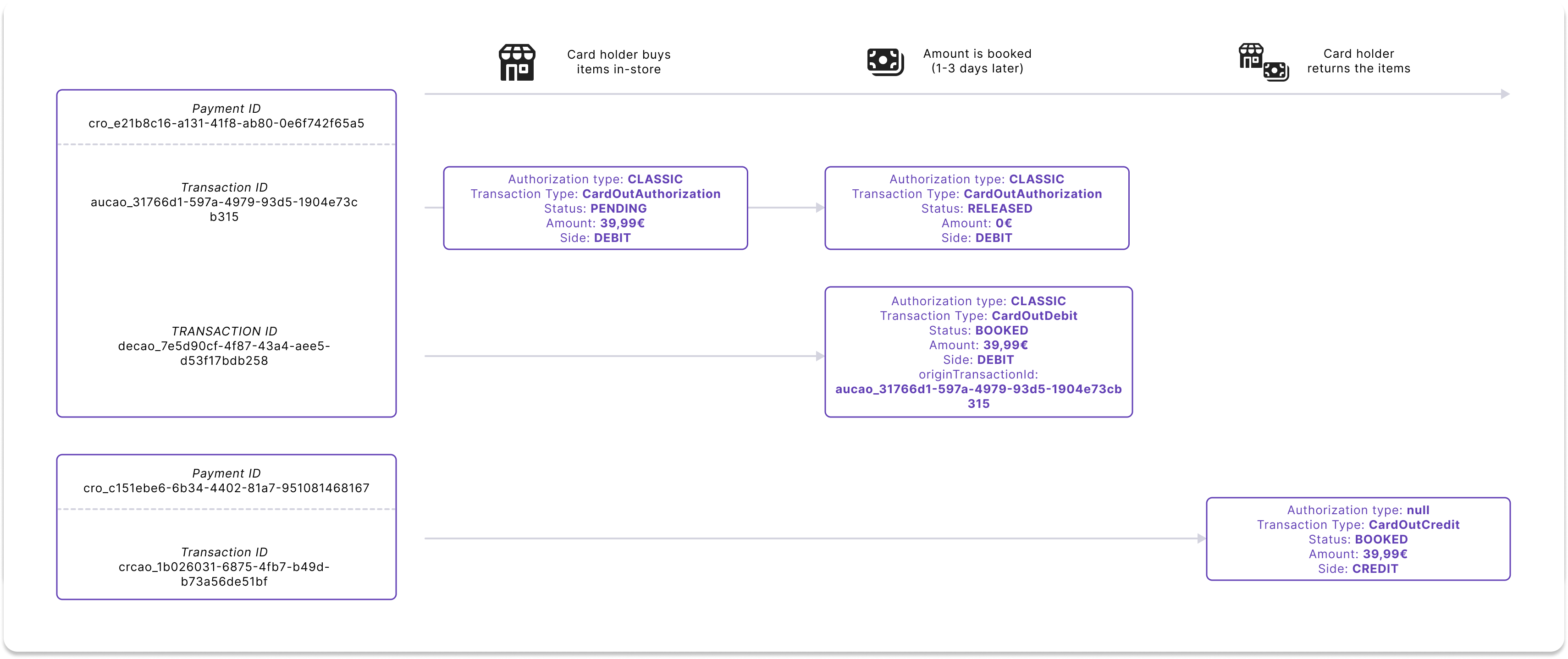

In-store return | Authorization + debit clearing + refund

When items are returned in-store, they can be hard to link back to the debit. When a merchant needs to refund a customer but can't connect the refund transaction to the original debit, they create a new credit transaction.

Consider a cardholder buying then returning an item in-store:

- The cardholder buys an item in-store.

- The merchant requests an authorization for the amount (39,99€).

- A few days later, the merchant debits the account of the amount (39,99€) and the authorization is released.

- Within the merchant's return window, the cardholder returns the item and the merchant credits the account of the amount (39,99€).

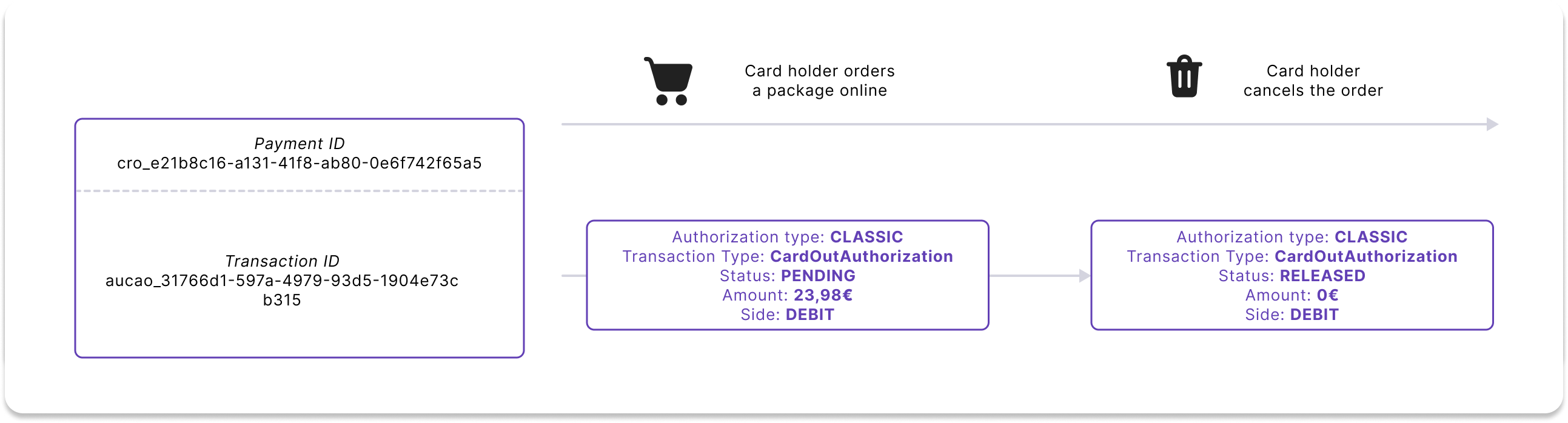

Canceled transaction | Authorization + release

To cancel a transaction, some merchants release the authorization to free up the amount that was requested.

Consider a cardholder placing an online order, then canceling it before the order ships:

- The cardholder orders a package online.

- The merchant requests an authorization for the amount (23,98€).

- The cardholder cancels the order before it ships, and the merchant releases the authorization.

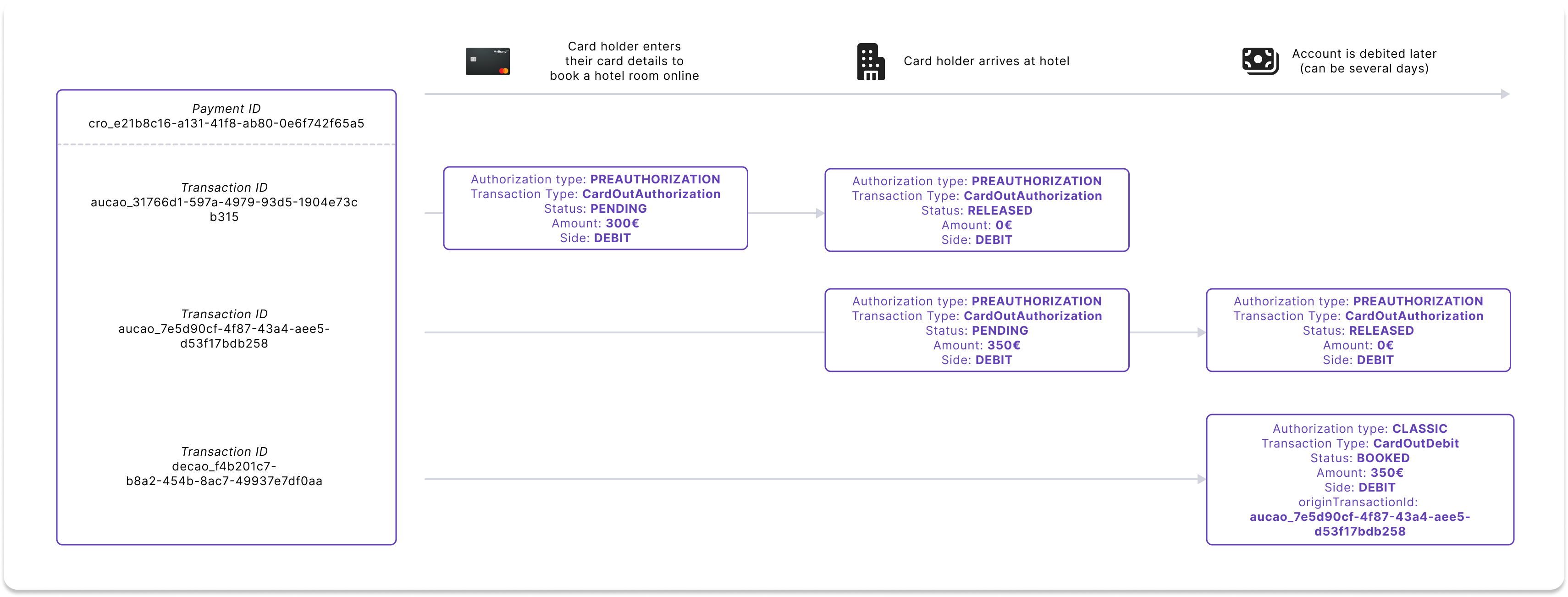

Booking a hotel | Multiple authorizations + debit clearing

When booking a hotel room, the hotel performs a preauthorization request to confirm the card is valid and to reserve all or part of the funds.

Consider a cardholder reserving a hotel room online:

- The cardholder enters their card details online to cover the room, but chooses the option without breakfast.

- The hotel requests a preauthorization of 300€.

- When the cardholder arrives at the hotel, they ask to add breakfast to their booking.

- The hotel releases the first preauthorization and requests a second of 350€.

- A few days later, the hotel debits the account the exact amount (350€) and the second preauthorization is released.

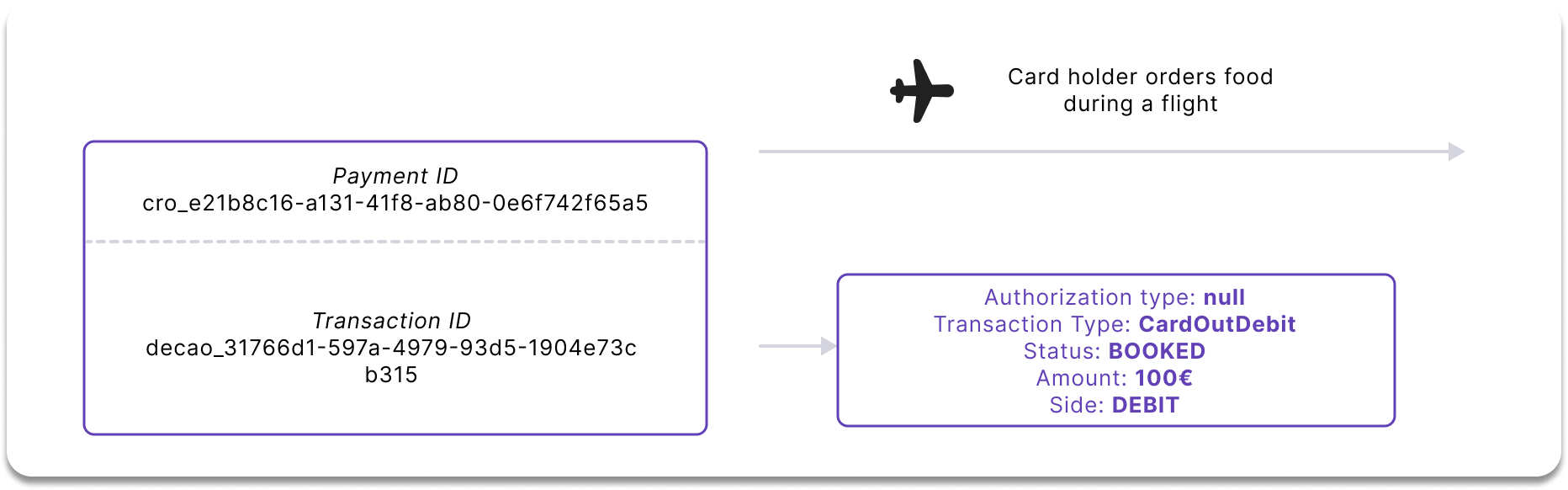

Purchase on airplane | Debit clearing only

In some situations, the merchant's point of sale isn't connected to the internet and the concerned card network. Certain payments are allowed offline, and these debits are done without a previous authorization. However, the cardholder can dispute the debit.

Consider a cardholder making a purchase on an airplane (such as food or duty-free items):

- The cardholder uses their card to initiate a 100€ purchase.

- When the merchant connects to the internet, they don't perform an authorization, but instead debit the amount directly.

3-D Secure (3DS)

3-D Secure (3DS) is an extra security layer for online card payments. All Swan cards, including single-use virtual cards, are subject to 3DS compliance; however, because single-use virtual cards require consent when being creating, 3DS is more seamless.

With 3DS, cardholders are required to perform Strong Customer Authentication before finalizing their payment. As a card issuer, Swan must comply with the European Revised Directive on Payment Services (PSD2). PSD2 governs all payments in Europe and mandates Strong Customer Authentication for some online payments.

Most European merchants use 3DS for all transactions, with a few exceptions. If a payment should require 3DS and doesn't (which probably means the merchant doesn't have the correct configuration), Swan rejects the operation.

In the case of recurring payments, such as subscriptions and automatic top-up, the merchant is only required to use 3DS during setup and not for subsequent recurring payments.

3DS consent flow

Swan designed a PSD2-compliant two-factor authentication (2FA) solution based on Mastercard's 3DS Smart Interface. Swan automatically detects card payments that require additional security and triggers the 3DS consent flow. Your cardholders are instructed to validate their online payments and can do so directly from their mobile phone.

There are two notable differences between 3DS and regular consent:

- Swan requires 3DS for online transactions — most transactions without it are refused — but it's up to the merchant to request 3DS, which initiates the consent flow.

- 3DS consent respects your configured notification preferences. If you've integrated consent notifications, you'll receive notifications for 3DS payments that you can forward to your users through your own channels.

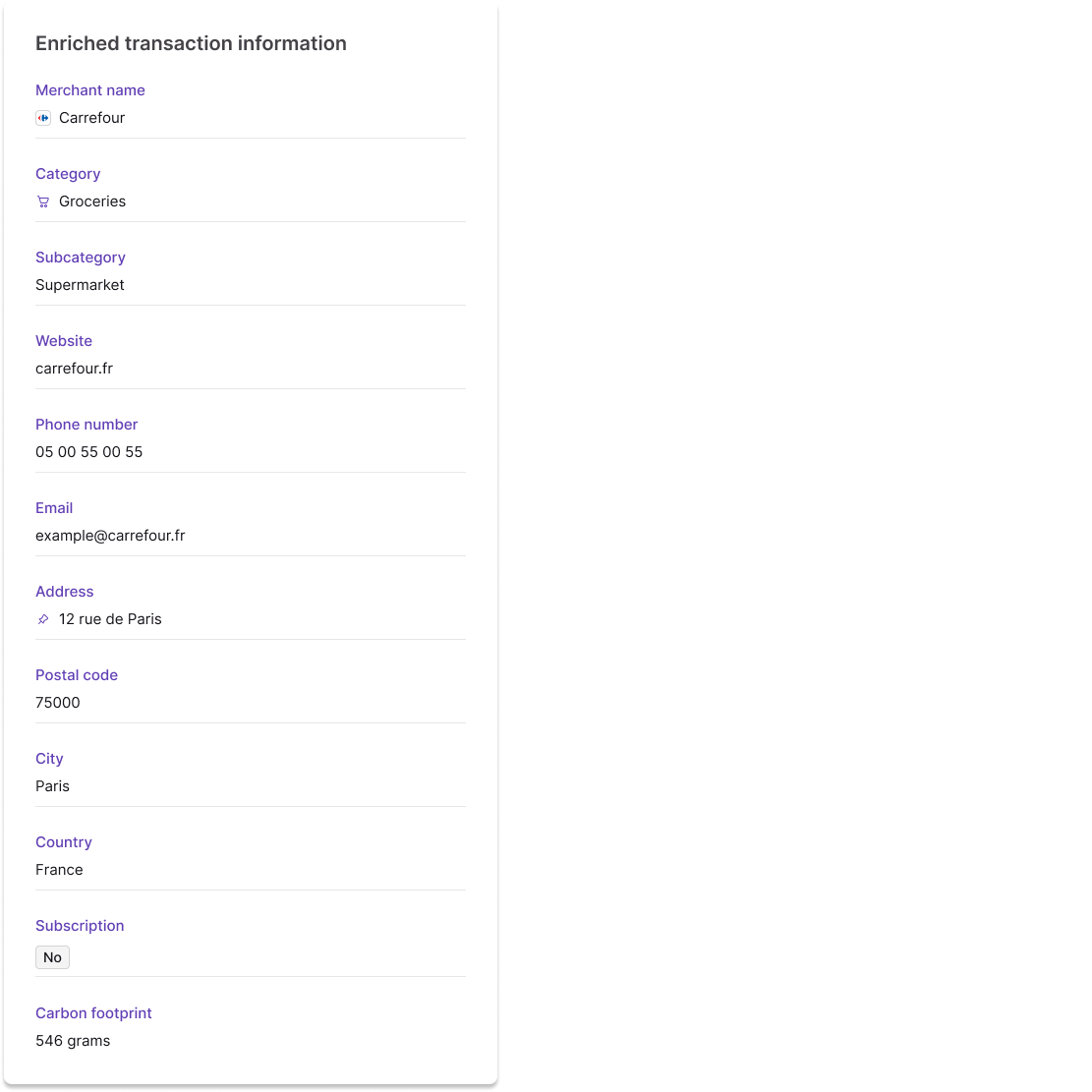

Enriched transaction information

When reviewing their transaction history, cardholders can see enriched information (more detailed data) about the merchant and the transaction. Providing enriched transaction information improves the user experience for you and your users. For example, enriched information can reduce chargebacks and decrease the need for customer support.

You can retrieve this information with the API and view it on your Dashboard by going to Data > Transactions > Details. If you use Swan's Web Banking interface, enriched transaction information is available for your users automatically in their History list.

Enriched transaction information is only available for card transactions at this time. It's available for all card transactions dating back to the beginning of Swan.

Swan enriches card transactions with the following data (as availability allows):

| API | Description | Example |

|---|---|---|

enrichedMerchantName | Merchant brand name | Carrefour |

logoUrl | Merchant logo | Small image of the merchant's logo, or, if no logo is available, the category icon |

category | Merchant category | Groceries |

subcategory | Merchant subcategory | Supermarket |

isSubscription | Subscription indicator boolean | Yes, No, null |

contactEmailcontactPhonecontactWebsite | Merchant contact details | example[@]carrefour.fr +330500550055 https://www.carrefour.fr |

citycountrypostalCodelatitudelongitude | Location details | Paris France (FRA) 75000 48.864716 2.349014 |

carbonFootprint | Carbon footprint in grams of CO2 emitted | 0.00546 grams |

Displaying enriched info

In the API and on your Dashboard, enrichedTransactionInfo doesn't override the existing merchant information received during the classic transaction flow.

If you use Swan's Web Banking interface, however, the enriched information overrides the merchant name.

The following image is sample enriched information as displayed on the Dashboard:

Webhooks and enriched info

Swan obtains enriched transaction information asynchronously to avoid processing delays and technical timeouts. The information is usually received within seconds after a card transaction is created.

Anytime enriched information is received, Swan triggers the Transaction.Enriched webhook.

In the Transaction.Enriched webhook notification, the resource ID is the transaction ID.

If enriched information is received when a transaction's status changes, the Transaction.Enriched webhook is triggered after the Transaction.Pending webhook.

Subscribe to both webhooks to stay updated on your transactions.