Glossary

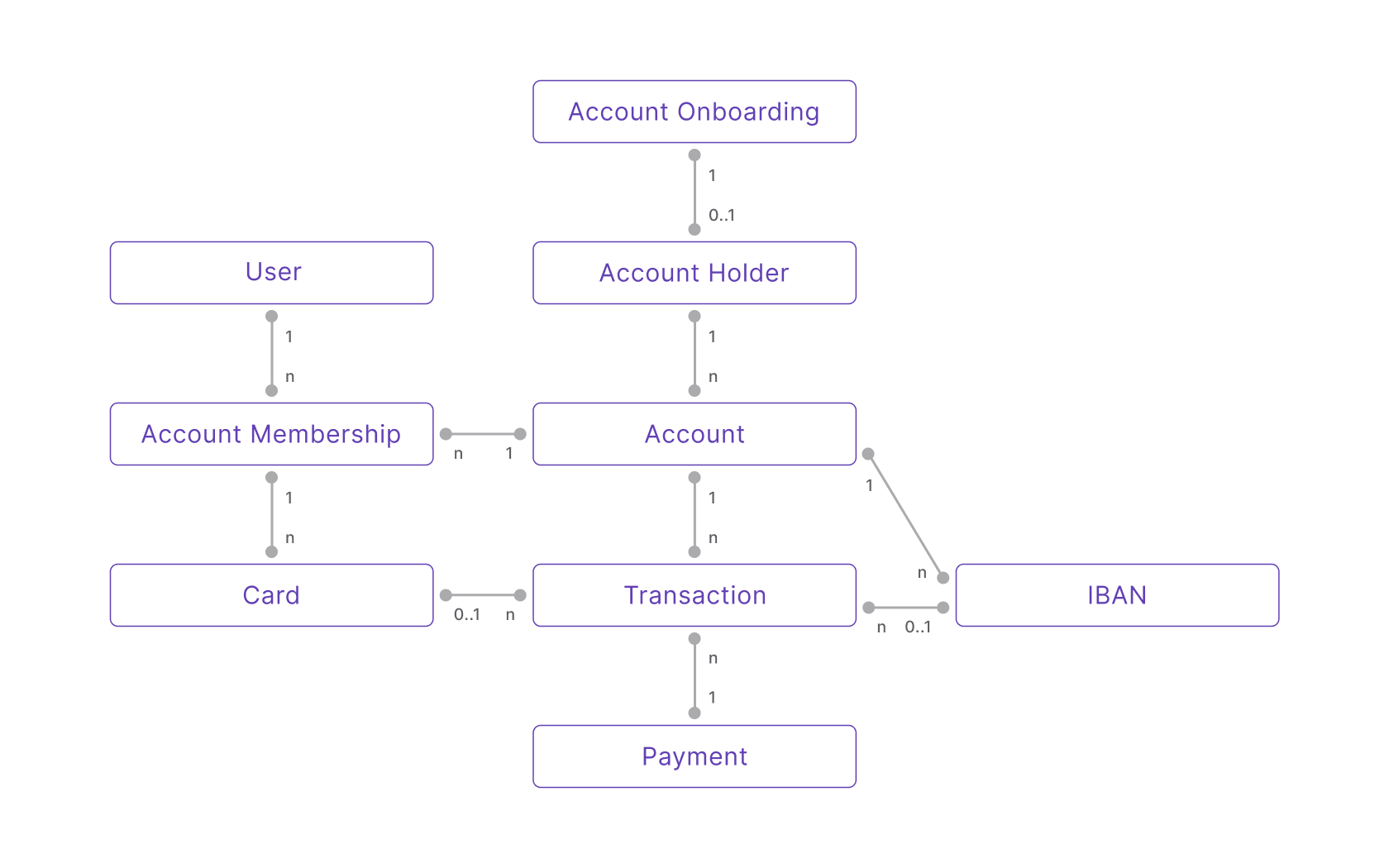

Swan data model

The Swan data model depicts the relationship between key elements that make up Swan.

1→ exactly one of that element per user0..1→ between zero and one of that element per usern→ an unlimited number of that element per user

Text description of data model

Account onboarding

Company account onboarding

Process of creating a new company account holder, and opening a new Swan account for that account holder.

Individual account onboarding

Process of creating a new individual account holder, and opening a new Swan account for that account holder.

Accounts

Account holder

Individual (natural person) or legal entity (legal person) who owns and is responsible for the funds in a Swan account. Account holders must be located in a country where Swan offers accounts, as listed on the country coverage page.

Account membership

Representation of the rights, also referred to as access and permissions, of Swan users to an account. While location is restricted for account holders, accounts members can be located anywhere in the world.

Account funding

Supply money to your Swan account from an external account, whether with a push payment (such as a credit transfer) or a pull payment (such as direct debit).

API

Swan's Application Programming Interface. Read more about the Swan API in the Developers section.

Idempotency

Unique string used to ensure API operations execute only once, preventing duplicate transactions during network issues or request retries.

Pagination

Break down large sets of data retrieved by the API into smaller, more manageable chunks.

Rejections

GraphQL type returned by mutations from the Swan API when a request is rejected due to a business rule. Rejections provide context as to why a mutation didn't work as expected and are implemented for all errors Swan can anticipate.

Webhooks

Computers use webhooks to communicate with each other about events. Like notifications, webhooks let you know when something you're interested in happens with your integration.

Capital deposit

Initial funds invested to start operations for a new company, involving required documents, shareholder information, and legal processes.

Card

Virtual cards

Swan's default, dematerialized cards. A virtual card must exist before creating a physical card or adding a card to a digital Wallet. Virtual cards are also available in a single-use format.

Physical cards

Plastic payment card that can be used for point-of-sale transactions using swipe, chip and PIN, and contactless (EMV) methods, as well as for online transactions.

Digital cards

Digital format of a virtual or physical card. Swan cards can be digitized and added to Apple Pay and Google Pay for Near-Field Communication (NFC) payments. Other digital wallets aren't supported.

IBAN

International Bank Account Numbers (IBANs) identify accounts on the Single Euro Payment Area (SEPA) network. This unique identifier makes it easy for banking services like Swan to make sure payments reach their destination safely across Europe.

Legal representative

Individual or entity authorized to act on behalf of another person or entity in legal and financial matters related to the Swan account.

Merchant

Swan account holders who are approved to accept payments from their customers using Swan.

Payment

A grouping of a single transaction or a series of transactions to move funds from one account to another. Payments group transactions together for two main reasons: the transactions were initiated at the same time, and they're related to the same operation or there is some other logical link between the transactions.

Payments can be initiated by individuals, businesses, or banks. Swan executes several types of payments denominated and executed in euros.

Payment control

Accept or reject transactions according to your business rules, in compliance with Mastercard's requirements.

Payment mandates

Signed approval through which a creditor or beneficiary can pull money from a debtor's account.

Several Swan features can require payment mandates, including account funding, accepting payments, and received payment mandates for SEPA Direct Debit.

Rolling reserve

Rolling reserve is a policy through which Swan holds a certain percentage of the total transaction amount for a contractually predetermined amount of time.

Swan applies rolling reserve to certain types of transactions (largely pull payment methods, such as direct debit and card transactions) to protect users and Swan against various risk factors, such as insufficient funds and attempted fraud. The reserved amount acts as a safety net to cover potential loss for both Swan and users.

Rolling reserve is expressed as a percentage over a period of time. For example, assume rolling reserve is 20% of the transaction amount held for 30 business days. Consider the following example:

A direct debit transaction for 150€ is made and requires rolling reserve.

Swan reserves, or holds back, 30€ for 30 business days, and 30€ is added to theReservedaccount balance.

After 30 business days, the 30€ is added to theAvailableaccount balance and can be used.

Rolling reserve timelines follow general SEPA availability.

Project

Entity that contains all information for your Swan integration and users.

Supporting documents

A collection of documents (think of a folder) containing documents gathered for a specific reason, such as when onboarding a new account holder or to collect information about a transaction. Swan collects these documents according to local regulations.

Transaction

Distinct and identifiable events that aid in moving money from one account to another. Transactions lay out the path to move money between accounts.