Verification of Payee

Verify beneficiary details before sending SEPA Credit Transfers to reduce fraud and payment errors.

Required for all SEPA Credit Transfers and Instant SEPA Credit Transfers under the European Instant Payments Regulation (IPR) published in March 2024, for all Payment Service Providers (PSPs) in the Eurozone offering SEPA Credit Transfers.

Overview

Verification of Payee (VoP) is a new European service that checks beneficiary details against account holder information before initiating SEPA Credit Transfers and Instant SEPA Credit Transfers. This service aims to reduce payment fraud and errors by confirming that the beneficiary details match the account holder registered with the beneficiary's bank.

Key benefits

For your integration:

- Reduced disputes: Prevent misdirected payments and end-user support tickets.

- Better user experience: Build trust through transparent payment verification.

- Operational efficiency: Fewer payment failures and reversals to handle.

For your end-users:

- Fraud protection: Ensure the funds go to the intended recipient.

- Error prevention: Catch typos and formatting issues early.

- Payment confidence: Know transfers will reach the intended recipient.

Geographic scope and timeline

VoP applies to all countries in the SEPA region. Payment Service Providers (PSPs) have varying implementation timelines based on their location:

| Payment Services Provider location | VoP mandatory date |

|---|---|

| 🇪🇺 Eurozone | October 9, 2025 |

| 🌐 Non-Eurozone | January 9, 2027 |

The service is free of charge for Swan account holders as mandated by the regulation.

Swan's VoP capabilities

Swan provides comprehensive VoP support as both a requesting and responding PSP:

- Outgoing VoP requests: When your users send transfers to external accounts, Swan verifies beneficiary details with the receiving bank before processing the payment.

- Incoming VoP requests: When other PSPs send transfers to Swan accounts, Swan automatically responds to their verification requests using account holder information.

This documentation primarily covers outgoing VoP requests that you can integrate into your application. Swan handles incoming VoP requests automatically without requiring any implementation from partners.

Learn about incoming VoP requests →

How VoP works

High-level flow

VoP happens before sending money to a beneficiary, through this process:

- VoP required: All SEPA Credit Transfers and Instant SEPA Credit Transfers must be verified before authorization.

- Verification request: Swan sends a VoP request to the beneficiary's bank with the IBAN and beneficiary name.

- Verification response: The beneficiary's bank responds with the verification result.

- Result displayed: VoP result and associated warnings are shown to the end-user.

Following the European Payments Council (EPC)'s recommended matching rules, the name is the first and last name of a natural person (individual), or the legal or commercial name of a legal person (company).

VoP results

The beneficiary's bank can return one of four verification results. All results must be displayed to the end-user. Swan will systematically display the VoP result and warning on the SCA consent screen.

- ✅ Match

- ⚠️ Close match

- ❌ No match

- ❌ Verification not possible

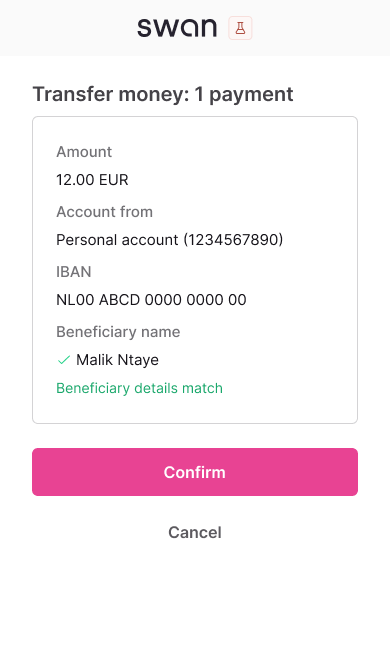

Result: Exact match found between provided details and account holder information

End-user action: Safe to proceed with transfer

Mobile consent screen:

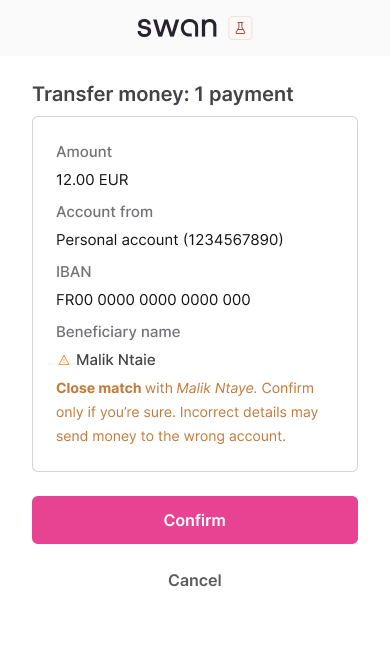

Result: Close match with suggested correction from beneficiary's bank

End-user action: Review suggested name correction before proceeding

Mobile consent screen:

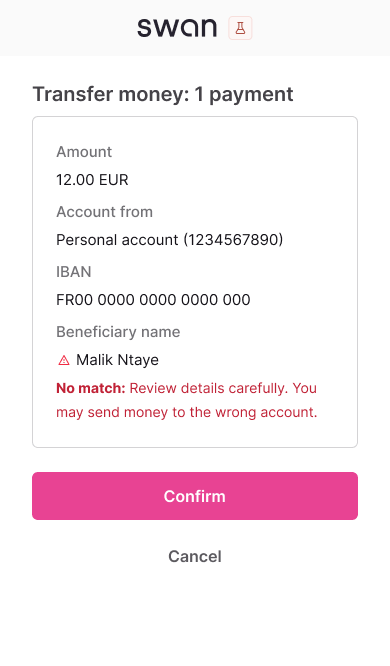

Result: No match found between provided details and account holder information

End-user action: Verify beneficiary details carefully before proceeding

Mobile consent screen:

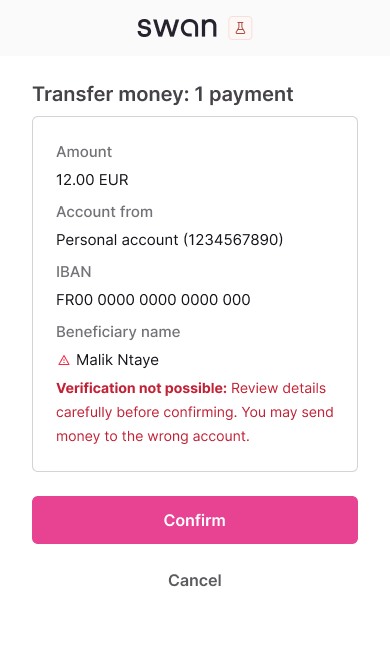

Result: IBAN verification failed. Check the IBAN format, try again, or contact the recipient's bank if the issue persists.

End-user action: Verify beneficiary details carefully before proceeding

Mobile consent screen:

Verification of Payee provides verification results so end-users can make informed decisions, but doesn't block payments from proceeding.

User liability with Verification of Payee

Users who authorize a transfer after receiving a Close Match, No Match, or Verification Not Possible warning accept the associated risks:

- The user bears responsibility if funds reach the wrong account.

- Refunds are not available for misdirected transfers.

Users can find complete VoP liability information in their Swan account's Terms and Conditions.

Standing Orders

VoP applies to Standing Orders with two key differences:

- Initial verification only: VoP happens at the scheduling stage when creating the Standing Order.

- Existing Standing Orders: Previously authorized Standing Orders don't need to be verified - only new Standing Orders created on or after October 9, 2025, will require VoP.

Integration flows for VoP

Swan provides two integration options based on your user experience (UX) needs and development limitations to ensure a compliant integration.

🟡 Option 1: Default verification

Swan automatically verifies beneficiary details when the end-user initiates a credit transfer

- No additional development required for single SEPA Credit Transfers.

- Swan displays VoP results and warnings in the consent screen.

- Best for: Quick compliance and existing integrations.

🟢 Option 2: Custom verification

Use the verifyBeneficiary mutation for full control over verification presentation

- Complete control over VoP results presentation.

- Custom error handling and user guidance.

- Required for bulk payments.

- Best for: Enhanced UX and high-volume use cases.

Supported payment types

Support Status Legend

| Payment Type | 🟡 Option 1: Default | 🟢 Option 2: Custom | VoP requirements |

|---|---|---|---|

| Single Credit Transfers | ✓ | ✓ | Required |

| Bulk Credit Transfers | ✗ | ✓ | See bulk transfers → |

| Standing Orders | ✓ | ✗ | Required at initiation stage |

Option 1: Default verification

For single credit transfers, you don't have to do anything - Swan will run the VoP check at the initiation of the credit transfer and display the VoP result in the consent screen.

Option 1 is not available for Bulk Credit Transfers. Instead, Option 2 is designed to handle high-volume payments efficiently and aligns with standard market practices.

Option 2: Custom verification

Call the verifyBeneficiary mutation before initiating SEPA Credit Transfers to get full control over the verification user experience. You can decide the level of friction here, but we recommend having clear warnings and CTAs to verify or edit beneficiary details based on the verification result.

Verification flow

- Verify beneficiary: Call the

verifyBeneficiarymutation - include the beneficiary details to check against. - Receive the verification result: Match, Close match, No Match, or Verification not possible. A unique

BeneficiaryVerificationTokenis also returned. - Inform the end-user: Display appropriate messaging and optional actions based on the verification result.

- User proceeds: The end-user can choose to proceed with the payment regardless of the result.

- Use token: Add the

beneficiaryVerificationTokento theCreditTransferInputin theinitiateCreditTransfersmutation. - User gives consent: Complete the payment authorization.

View detailed implementation →

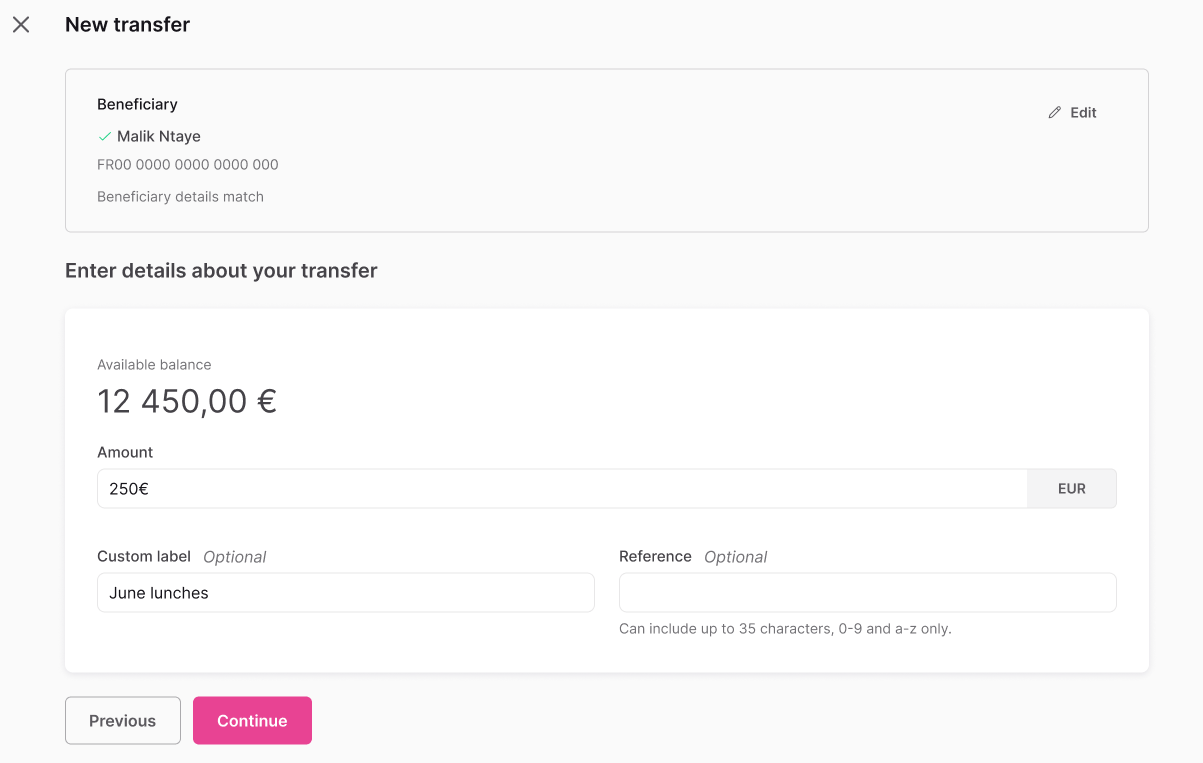

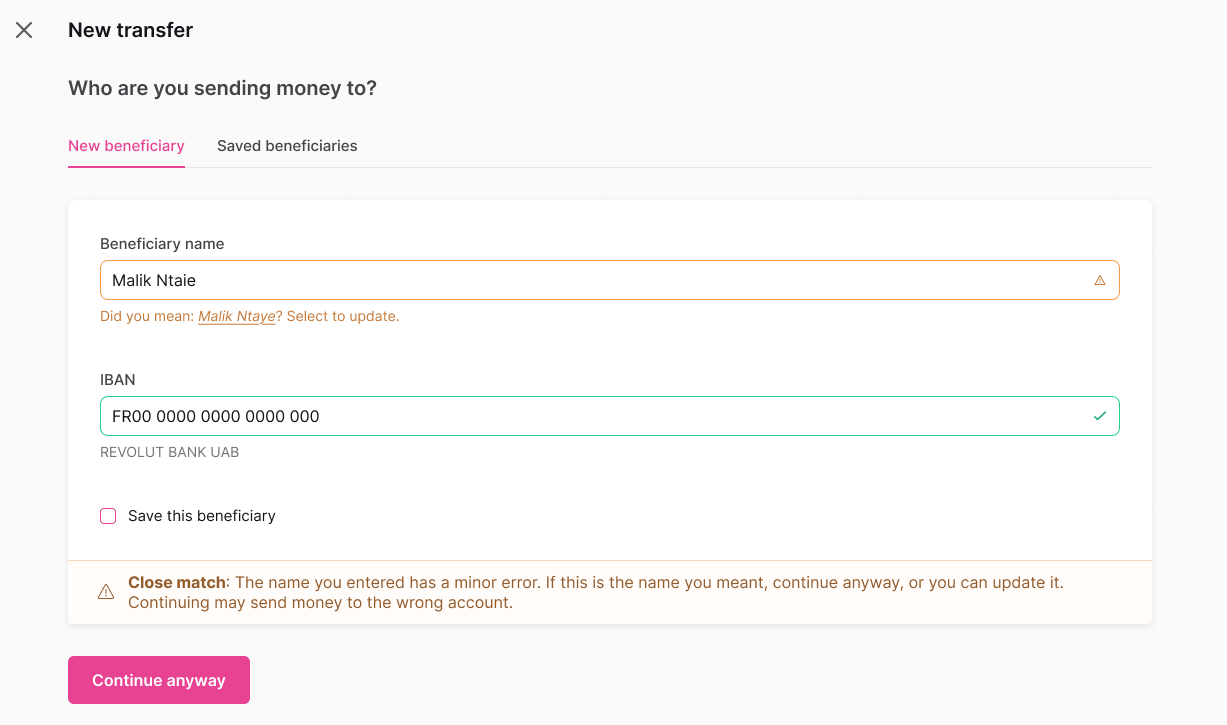

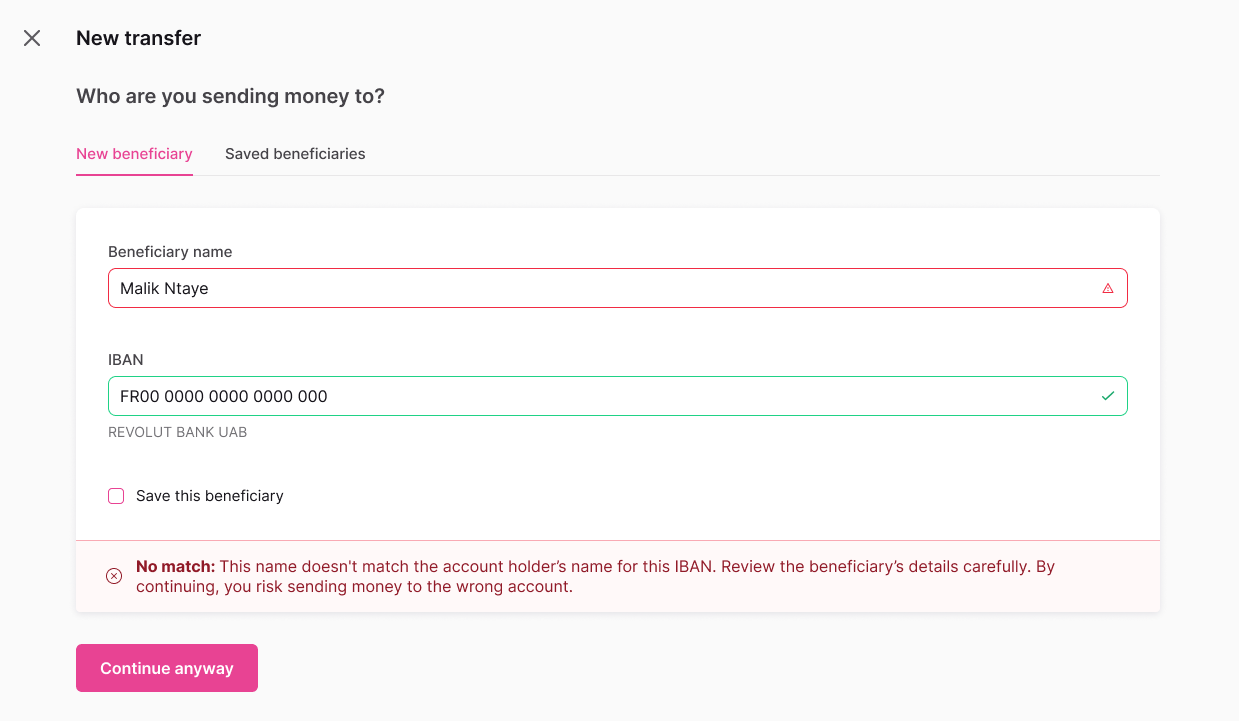

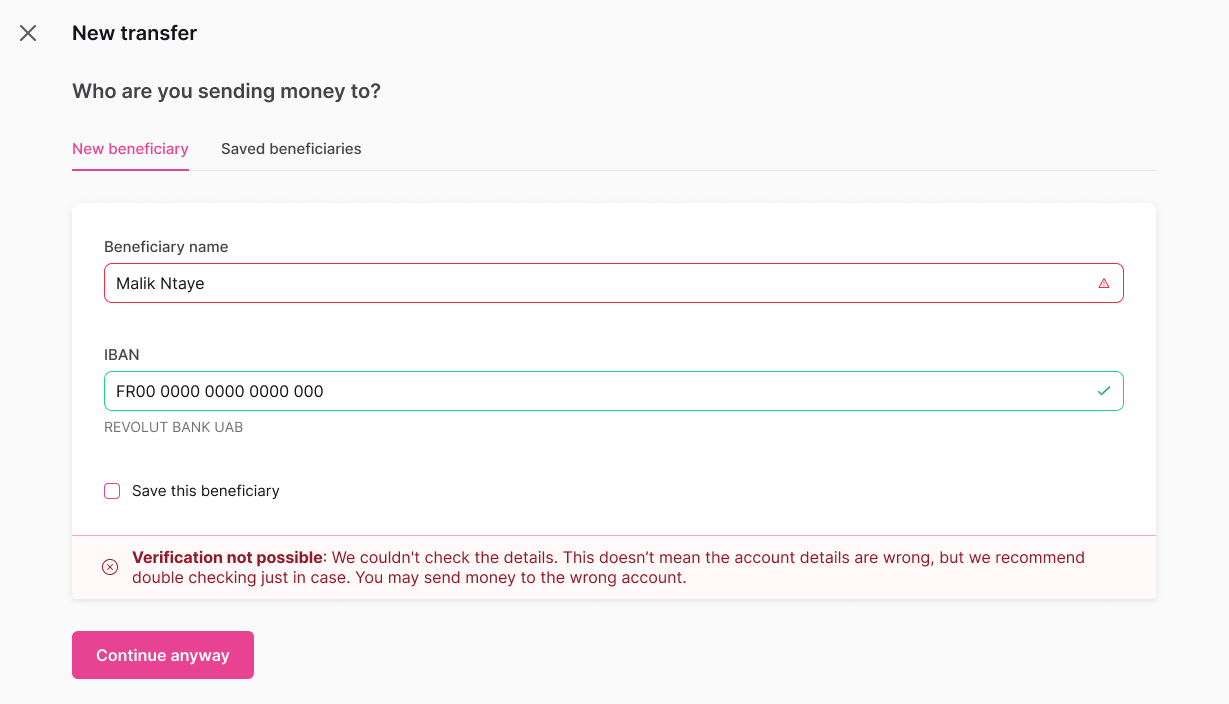

Custom UX examples

Examples of how to present VoP verification results in your web banking interface during the "Custom UX handling" step. You can decide the level of friction and optional actions to display.

- ✅ Match

- ⚠️ Close match

- ❌ No match

- ❌ Verification not possible

Recommended actions: None required - proceed with payment

Recommended actions:

- Display the suggested name correction.

- Offer to update the beneficiary name.

- Allow proceeding with the original or suggested name.

Recommended actions:

- Clear warning about the mismatch.

- Option to edit the beneficiary details.

- Option to verify the IBAN with recipient.

- Allow proceeding with caution.

Recommended actions:

- Explain verification is unavailable.

- Suggest checking the IBAN format.

- Option to contact the recipient's bank.

- Allow proceeding with caution.

Bulk credit transfers

For bulk credit transfers, VoP requirements depend on the account type and account-level verification settings. Company accounts can customize their VoP requirements, while individual accounts always require verification tokens for bulk transfers.

Bulk credit transfers require Option 2: Custom verification using the verifyBeneficiary mutation. The default verification flow doesn't support bulk payments.

Default requirements by account type

Field Requirements Legend

| Account type | Default token requirement | Can modify setting |

|---|---|---|

| Company | ○ OPT | ✓ |

| Individual | ● REQ | ✗ |

Learn more: Configure bulk credit transfers with VoP →

Next steps

→ Learn how to verify beneficiary details using the verifyBeneficiary mutation

→ Configure bulk credit transfers with VoP for high-volume use cases

→ Understand how Swan handles incoming VoP requests automatically