International Credit Transfers

Overview

Send and receive money almost anywhere in the world using a Swan International Credit Transfer.

With Swan International Credit Transfers, you can:

Exchange euros for a different currency, then transfer that money on either local rails or the SWIFT network.

- Transfer euros outside of the eurozone using the SWIFT network.

- Receive credit transfers initiated outside of the eurozone. You'll receive these transfers in euros as Swan doesn't store money in currency other than euros.

International Credit Transfers follow the standard credit transfer status flow with one exception: they can't have the status Upcoming.

Risk with international transfers

International transfers can introduce more significant risk than transfers that don't cross borders or change currencies. Additionally, since more legal jurisdictions are involved, Swan International Credit Transfers must follow regulations for multiple regions.

Potential areas for increased risk and friction include: instability in the target region, diverging requirements for consent or identity documents, different reactions in the case of disputed transactions, fluctuation in currency value and exchange rate, and more.

Therefore, Swan prioritizes a risk-based approach, which applies to you and your end users. In addition to increased scrutiny in the transaction-review process, both automated and manual, Swan uses dynamic forms in the International Credit Transfer API.

Outgoing allowed countries

Your users can send International Credit Transfers on local rails in local currencies.

They can also send International Credit Transfers on the SWIFT network swift_code using United States Dollars USD, Euros EUR, or Great British Pounds GBP.

Any attempt to send a SWIFT transfer in other currencies is rejected.

Refer to the following lists for allowed countries and rails.

✅ Transfers in local currencies using local rails

Users can send International Credit Transfers in the following currencies using the corresponding available rails. For example, the Indonesian Rupiah IDR can only be sent on the indonesian rail. Attempts to send currencies using rails not listed on this table are rejected.

| Currency | Available rails | Fee group |

|---|---|---|

🇦🇺 AUD Australian Dollar | australian, australian_bpay | 1 |

🇧🇷 BRL Brazilian Real∗ | brazil | 3 |

🇨🇦 CAD Canadian Dollar | iban | 1 |

🇨🇭 CHF Swiss Franc | iban | 1 |

🇨🇱 CLP Chilean Peso | chile | 4 |

🇪🇺 EUR Euro | swift_code | 1 |

🇬🇧 GBP Great British Pound Sterling | iban, sort_code, swift_code | 1 |

🇭🇰 HKD Hong Kong Dollar | hongkong, hong_kong_fps | 2 |

🇮🇩 IDR Indonesian Rupiah | indonesian | 2 |

🇮🇱 ILS Israeli New Shekel | israeli_local | 4 |

🇮🇳 INR Indian Rupee | indian, indian_upi | 2 |

🇯🇵 JPY Japanese Yen | japanese | 2 |

🇰🇷 KRW South Korean Won | south_korean_paygate, south_korean_paygate_business | 3 |

🇲🇽 MXN Mexican Peso | mexican | 2 |

🇲🇾 MYR Malaysian Ringgit∗ | malaysian, malaysian_duitnow | 2 |

🇳🇿 NZD New Zealand Dollar | newzealand | 1 |

🇸🇬 SGD Singapore Dollar | singapore, singapore_paynow | 2 |

🇹🇭 THB Thai Baht | thailand | 2 |

🇺🇸 USD United States Dollar | fedwire_local, aba, swift_code | 1 |

🇺🇾 UYU Uruguayan Peso | uruguay | 4 |

🇻🇳 VND Vietnamese Dong | vietname_earthport | 2 |

∗ Currencies marked with a single asterisk can't be sent from a Swan company account.

✅ swift_code + 🇺🇸 United States Dollars USD

Users can send International Credit Transfers in United States Dollars USD using the swift_code rail to the listed countries. Attempts to send United States Dollars USD using swift_code to countries not listed are rejected.

United States Dollars USD are in fee group 1.

| First letter | Allowed countries for outgoing Swift + USD transfers |

|---|---|

| A - B | Albania, Algeria, Andorra, Angola, Anguilla, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Barbados, Belgium, Bhutan, Bolivia, Botswana, Bosnia & Herzegovina, Brunei Darussalam, Bulgaria, Burkina Faso |

| C - E | Canada, Cambodia, Cayman Islands, Channel Islands, Chile, China, Christmas Island, Cocos (Keeling) Islands, Cook Islands, Costa Rica, Côte d'Ivoire, Croatia, Cyprus, Czech Republic, Denmark, Dominica, Dominican Republic, Ecuador, El Salvador, Estonia, Ethiopia |

| F - G | Falkland Islands (Malvinas), Faroe Islands, Fiji, Finland, France, French Guiana, French Polynesia, Gabon, Gambia, Georgia, Germany, Ghana, Gibraltar, Greece, Greenland, Grenada, Guadeloupe, Guatemala, Guernsey, Guinea, Guyana |

| H - L | Haiti, Holy See (Vatican City State), Honduras, Hong Kong (locally with the CHATS system), Hungary, Iceland, India, Indonesia, Ireland, Isle of Man, Israel, Italy, Jamaica, Japan, Jersey, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Laos, Latvia, Liberia, Liechtenstein, Lithuania, Luxembourg |

| M - O | Macao SAR China, Macedonia (Republic of North), Malawi, Malaysia, Malta, Marshall Islands, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Micronesia (Federated States of), Monaco, Mongolia, Montenegro, Montserrat, Morocco, Namibia, Nauru, Nepal, Netherlands, New Caledonia, New Zealand, Niger, Niue, Norfolk Island, Northern Mariana Islands, Norway |

| P - S | Palau, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Reunion, Romania, Rwanda, Saint Helena, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and Grenadines, Samoa, San Marino, Sao Tome and Principe, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, South Africa, South Korea, Spain, Sri Lanka, Suriname, Sweden, Switzerland |

| T - Z | Taiwan (Republic of China), Tajikistan, Tanzania, Thailand, Timor-Leste, Tonga, Trinidad and Tobago, Tunisia, Turks and Caicos Islands, Tuvalu, Uganda, Ukraine (both PrivatBank and non-PrivatBank recipients), United Arab Emirates, United Kingdom, Uruguay, Uzbekistan, Vanuatu, Vietnam, Wallis and Futuna Islands, Zambia |

✅ swift_code + 🇪🇺 Euros EUR

Users can send International Credit Transfers in Euros EUR using the swift_code rail to the listed countries. Attempts to send Euros EUR using swift_code to countries not listed are rejected.

Euros EUR are in fee group 1.

| First letter | Allowed countries for outgoing Swift + EUR transfers |

|---|---|

| A - B | Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antigua and Barbuda, Argentina, Armenia, Aruba, Australia, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Benin, Bermuda, Bhutan, Bolivia, Bosnia and Herzegovina, Botswana, British Virgin Islands, Brunei Darussalam, Burkina Faso |

| C - E | Cambodia, Cape Verde, Cayman Islands, Channel Islands, Chile, China, Christmas Island, Cocos (Keeling) Islands, Cook Islands, Costa Rica, Côte d’Ivoire, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Ethiopia |

| F - G | Falkland Islands (Malvinas), Faroe Islands, Fiji, French Polynesia, Gabon, Gambia, Georgia, Ghana, Greenland, Grenada, Guatemala, Guinea-Bissau, Guyana |

| H - L | Haiti, Holy See (Vatican City State), Honduras, Hong Kong, SAR China (locally with the CHATS system), India, Indonesia, Israel, Jamaica, Japan, Kazakhstan, Kenya, Kiribati, South Korea, Kosovo, Kuwait, Kyrgyzstan, Lao PDR, Lesotho, Liberia |

| M - O | Macao, SAR China, Macedonia (Republic of North), Malawi, Malaysia, Maldives, Marshall Islands, Mauritania, Mauritius, Mexico, Micronesia (Federated States of), Moldova, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Namibia, Nauru, Nepal, New Caledonia, New Zealand, Niger, Niue, Norfolk Island, Oman |

| P - S | Palau, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Qatar, Rwanda, Saint Helena, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and Grenadines, Samoa, San Marino, Sao Tome and Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Solomon Islands, South Africa, Sri Lanka, Suriname |

| T - Z | Taiwan (Republic of China), Tajikistan, Tanzania (United Republic of), Thailand, Timor-Leste, Tonga, Trinidad and Tobago, Tunisia, Tuvalu, Uganda, Ukraine, United Arab Emirates, United Kingdom, United States of America, Uruguay, Uzbekistan, Vanuatu, Vietnam, Wallis and Futuna Islands, Zambia |

✅ swift_code + 🇬🇧 Great British Pounds GBP

Users can send International Credit Transfers in Great British Pounds GBP using the swift_code rail to the listed countries. Attempts to send Great British Pounds GBP using swift_code to countries not listed are rejected.

Great British Pounds GBP are in fee group 1.

| First letter | Allowed countries for outgoing Swift + GBP transfers |

|---|---|

| A - L | Albania, Aruba, Azerbaijan, Bahrain, Bangladesh, Bermuda, Bosnia and Herzegovina, British Virgin Islands, Cape Verde, Costa Rica, Dominican Republic, Egypt, Faroe Islands, Georgia, Greenland, Guatemala, Kazakhstan, Kosovo, Kuwait, Israel, Lesotho |

| M - Z | Maldives, Moldova, Montenegro, Mozambique, Mauritania, Mauritius, North Macedonia, Oman, Qatar, Saint Lucia, Serbia, Saudi Arabia, Seychelles, Sao Tome and Principe, Tunisia, Timor-Leste, Ukraine, United Arab Emirates (UAE) |

Incoming allowed countries

Incoming International Credit Transfers are only allowed from accounts located in the following countries. If a country isn't on the following list, incoming transfers are rejected.

✅ Allowed countries for incoming transfers

| First letter | Allowed countries for incoming transfers |

|---|---|

| A - G | Algeria, Andorra, Armenia, Aruba, Australia, Austria, Bahrain, Belgium, Brazil, Canada, Chile, Colombia, Cyprus, Czechia, Denmark, Dominican Republic, Estonia, Finland, France, Georgia, Germany, Greece, Guatemala, Guyana |

| H - O | Honduras, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Liechtenstein, Lithuania, Luxembourg, Malaysia, Malta, Martinique, Mayotte, Mexico, Moldova, Netherlands, New Zealand, Norway |

| P - Z | Paraguay, Peru, Poland, Portugal, Romania, San Marino, Singapore, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Thailand, United Kingdom of Great Britain and Northern Ireland, United States of America, Uruguay, Uzbekistan |

Fees

There are fees for executing international transfers according to the non-euro currency selected.

Each eligible currency is assigned to a fee group, numbered 1 through 4. Swan determined the groups based on how much it costs to execute a transfer with that currency. For example, it costs less to execute a transfer between euros and a currency in fee group 1 than with a currency in fee group 3. The lists of allowed countries for outgoing transfers include each currency's fee group.

The fees listed on this page are always paid by the Swan user.

| Fee group | Outgoing transfer fee ∗ | Incoming transfer fee ∗∗ |

|---|---|---|

| Group 1 | 5€ + 0.6% | 5€ (+ 0.6%) |

| Group 2 | 5€ + 1% | 5€ (+ 1%) |

| Group 3 | 5€ + 2% | 5€ (+ 2%) |

| Group 4 | 5€ + 5% | 5€ (+ 5%) |

∗ For outgoing transfers, an additional 5€ fee is charged when sending USD, GBP, and EUR through SWIFT. For these currencies, the total fee is 10€ + the percentage % indicated in the table.

∗∗ For incoming transfers, the additional fee percentage (in parentheses) only applies to transfers not already converted into euros.

Fees are charged in their own transaction. Therefore, each International Credit Transfer creates two transactions on your transaction history: one for the transfer and one for fees. Fees and transfer transactions are created, booked, and rejected simultaneously. Both transactions have the same status.

This section shares Swan's standard pricing, which might vary based on your contract.

Outgoing transfers

Payment rails

Initiate transfers using one of two payment rails: local or SWIFT. Choose your rail when declaring your beneficiary.

| Payment rail | Description | Benefit |

|---|---|---|

| Local bank transfers |

| Faster, less expensive |

| SWIFT network |

| Wider availability |

Currency exchange

Transferring money internationally requires currency exchange. Think of currency exchange as the cost of selling one currency to purchase another.

Currency exchange is always charged for outgoing transfers.

Swan uses a mid-market rate, or the midpoint between the buy and sell prices for the two currencies involved in a transfer, with no added spread.

For outgoing International Credit Transfers, the exchangeRate is determined when a transfer is initiated.

After initiating the transfer, the exchange rate is locked for one business day, even if the market rate changes. During this time, users must provide consent to execute the transfer. If the day passes without consent, Swan no longer guarantees the exchange rate. Therefore, the transfer will be rejected and the user would need to initiate a new transfer.

Find the exchange rate, as well as fees, in the success payload of the initiateInternationalCreditTransfer mutation, as well as when consenting to the transfer.

Outgoing transaction statuses

Outgoing International Credit Transfers cycle through three possible transaction statuses.

| Status | Explanation |

|---|---|

Pending | Status assigned when the transfer is initiated; the transfer retains the status Pending while the transactions associated with the transfer follow the standard transaction status flow |

Booked | Funds arrived in the beneficiary's account |

Rejected | Transfer isn't executed for any of several reasons, including insufficient funds, lack of consent, and more |

Rejected transactions

There are several reasons an International Credit Transfer might be rejected. For example, some of the account or bank details might be incorrect, the account might be closed, or a required mandate was never provided.

However, a common reason for all rejections is insufficient funds.

For all outgoing International Credit Transfers, Swan checks the account balance to make sure there is enough money to cover both the transfer amount and the fees. If there isn't enough money in the account to cover both the transfer amount and the fees, the transfer will be rejected for insufficient funds.

If a transfer is rejected, fees aren't charged. If a transfer is returned, fees are also refunded.

Outgoing sequence diagram

API dynamic forms

Swan's outgoing International Credit Transfer API uses dynamic forms.

Dynamic forms mean that the information requested changes based on the information you submit in each query. For example, the required information will be different for a beneficiary in India than for a beneficiary in the UK.

Integrating dynamic forms

Dynamic forms make this feature more challenging to integrate for your custom integrations.

In your integration, you should only request the most basic information per query, as shown in the API Explorer. Specific logic is then required to retrieve the correct key/value pairs according to the information submitted in the dynamic fields.

The concept of refreshable dynamic fields is illustrated in the guide to get beneficiary information.

Dynamic forms allow Swan to collect only required information from your end users, collected in the format of key/value pairs. Some locations require a few key/value pairs while others might require 10 or more.

Since the required information changes frequently and is outside of Swan's control, dynamic forms provide the best way to only collect the correct information, which also minimizes risk and ensures secure transactions.

Query and mutation order

Due to these dynamic forms, it's critical to run the queries in order before running the mutation.

- Optionally, get a quote.

- This query provides a quote for the exchange rate and fees.

- The quote isn't guaranteed.

- Next, get the list of required key/value pairs for your beneficiary.

- They're based on the target currency and the beneficiary's country of residence.

- Then, get the list of required key/value pairs for your transaction.

- They're based on the transfer's destination.

- Finally, initiate your transfer.

Incoming transfers

Debtors can send credit transfers to Swan accounts, regardless of the debtor's account currency. Swan's existing Bank Identifier Codes (BICs) are connected to SWIFT, so Swan users don't need an additional IBAN to receive SWIFT transfers.

Swan and intermediary bank details for incoming transfers

- Swan address

- Name: Swan SAS

- Address: 95 Avenue du Président Wilson

- Postal code: 93100

- City: Montreuil

- Country: France

- Swan BIC and SWIFT code:

SWNBFR22 - Intermediary information:

- SWIFT:

TRWIBEB3 - Name: Wise Europe SA

- Country: Belgium

- SWIFT:

Standard flow

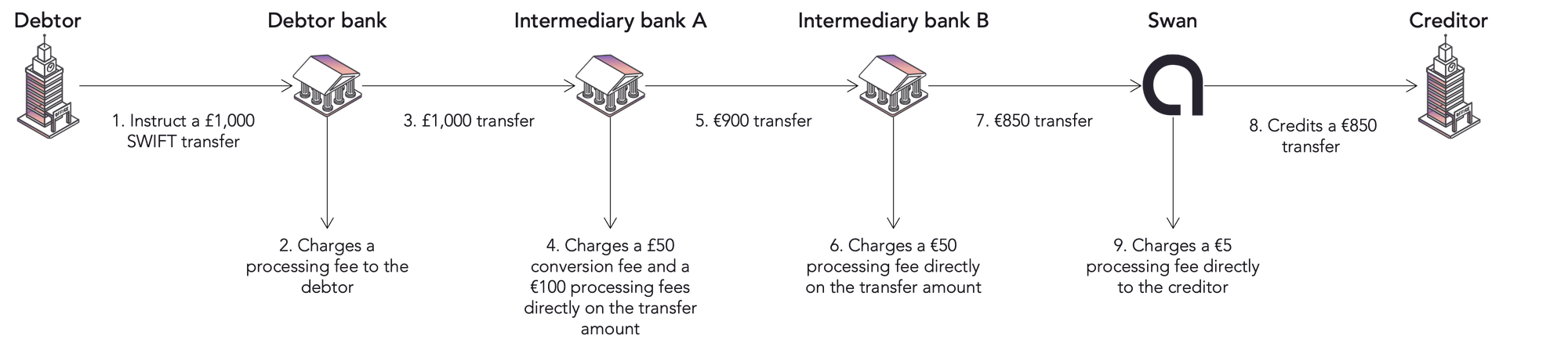

Consider the following image:

- Debtor initiates a transfer of £1,000 (GBP) to a Swan account.

- Debtor's bank charges them a processing fee.

- Debtor's bank then passes the £1,000 to a first intermediary bank.

- Swan only has euro-based accounts, so intermediary bank A converts the transfer from GBP to EUR.

- They charge a £50 fee to convert the currency.

- They charge an additional €100 (EUR) processing fee.

- Since the transfer was initiated with shared fees, intermediary bank A deducts their fees directly from the transfer amount.

- Intermediary bank A then passes the transfer on to a second intermediary bank.

- After the conversion and the fee deduction, €900 remains.

- Intermediary bank B charges a €50 processing fee and deducts it from the transfer amount.

- Intermediary bank B passes the transfer on to Swan.

- After the conversion and the fee deduction, €850 remains.

- Swan books the incoming SWIFT transfer's remaining amount (€850) immediately to the Swan user's account.

- Swan charges a €5 processing fee separately from the transfer.

SWIFT details

Incoming International Credit Transfers sent on SWIFT can be sent with one of the following specifications:

SHA: Splits fees between the debtor and their beneficiary. For instance, the payer might pay the fees charged by their bank and the beneficiary might pay the intermediary banks fees. The standard flow example usesSHA.BEN: All fees paid by the beneficiary by deducting them from the transaction amount.OUR: All fees paid by the debtor. Some banks might not respect this, though, so it’s possible to receive an intermediary bank fee as a beneficiary anyway.

Booked transfers

When Swan receives an incoming International Credit Transfer, Swan books it immediately and creates a InternationalCreditTransferTransaction type (step 8 in the standard flow described).

Use the transactions query with the ID for your International Credit Transfer to get information.

Notifications

You can use the Transaction.Booked webhook to be notified any time a transaction is created.

{

"eventDate": "2023-11-22T14:25:32.133Z",

"eventId": $WEBHOOK_EVENT_ID,

"eventType": "Transaction.Booked",

"projectId": $YOUR_PROJECT_ID,

"secret": null,

"resourceId": $INCOMING_TRANSACTION_ID,

"retryCount": 0

}

Currency exchange

Transferring money internationally requires currency exchange. Think of currency exchange as the cost of selling one currency to purchase another.

For incoming transfers, you can view the exchangeRate in the InternationalCreditTransferTransaction type, created when the transaction is booked.

Other currency exchange information isn't available for incoming transfers.

Typically, incoming transfers arrive in euros. If Swan performs the currency exchange, the additional fees in parentheses listed in the fees table for incoming transfers are charged. For example, if Swan receives a transfer in United States Dollars, 0.6% of the received amount is charged along with the standard €5 fee.

Guides

- Outgoing transfers

- Get information about a transfer

- Add a trusted international beneficiary

- Sandbox, including how to simulate receiving an incoming International Credit Transfer