Verification of Payee

Verify beneficiary details before sending SEPA Credit Transfers to reduce fraud and payment errors.

Required for all SEPA Credit Transfers and Instant SEPA Credit Transfers under the European Instant Payments Regulation (IPR) published in March 2024, with a mandatory implementation deadline of October 9, 2025, for all Payment Service Providers (PSPs) in the Eurozone offering SEPA Credit Transfers.

Overview

Verification of Payee (VoP) is a new European service that checks beneficiary details against account holder information before initiating SEPA Credit Transfers and Instant SEPA Credit Transfers. This service aims to reduce payment fraud and errors by confirming that the beneficiary details match the account holder registered with the beneficiary's bank.

Key benefits

For your integration:

- Reduced disputes: Prevent misdirected payments and end-user support tickets.

- Better user experience: Build trust through transparent payment verification.

- Operational efficiency: Fewer payment failures and reversals to handle.

For your end-users:

- Fraud protection: Ensure the funds go to the intended recipient.

- Error prevention: Catch typos and formatting issues early.

- Payment confidence: Know transfers will reach the intended recipient.

Geographic scope and timeline

VoP applies to all countries in the SEPA region. Payment Service Providers (PSPs) have varying implementation timelines based on their location:

| Payment Services Provider location | VoP mandatory date |

|---|---|

| 🇪🇺 Eurozone | October 9, 2025 |

| 🌏 Non-Eurozone | January 9, 2027 |

The service is free of charge for Swan account holders as mandated by the regulation.

How VoP works

High-level flow

VoP happens before sending money to a beneficiary, through this process:

- VoP required: All SEPA Credit Transfers and Instant SEPA Credit Transfers must be verified before authorization.

- Verification request: Swan sends a VoP request to the beneficiary's bank (Responding PSP).

- Verification response: The beneficiary's bank responds with the verification result.

- Result displayed: VoP result and associated warnings are shown to the end-user.

VoP results

The beneficiary's bank can return one of four verification results. All results must be displayed to the end-user. Swan will systematically display the VoP result and warning on the SCA consent screen.

- ✅ Match

- ⚠️ Close match

- ❌ No match

- ❌ Verification not possible

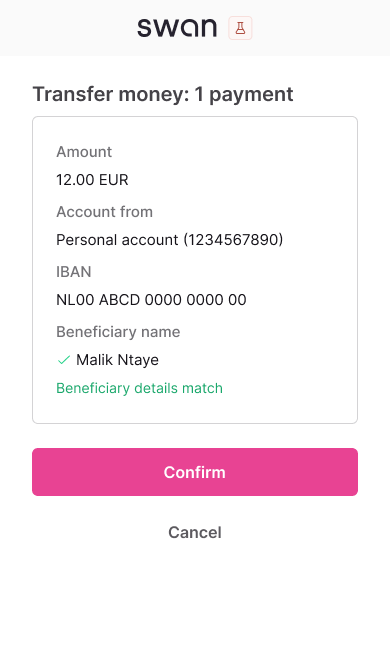

Result: Exact match found between provided details and account holder information

End-user action: Safe to proceed with transfer

Mobile consent screen:

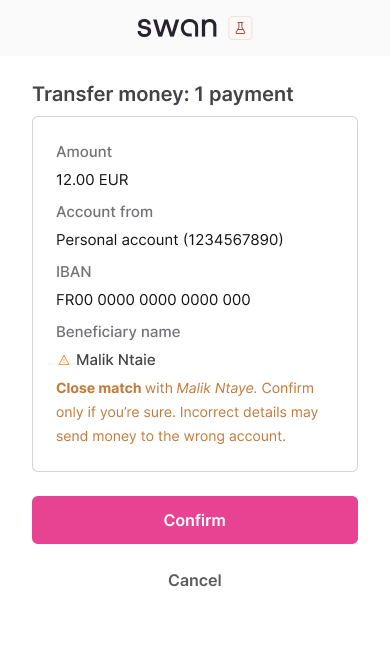

Result: Close match with suggested correction from beneficiary's bank

End-user action: Review suggested name correction before proceeding

Mobile consent screen:

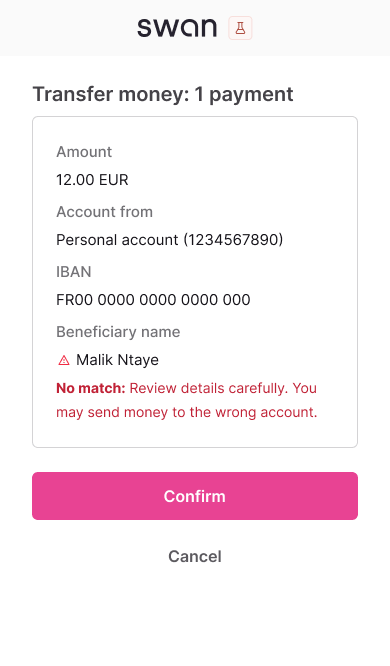

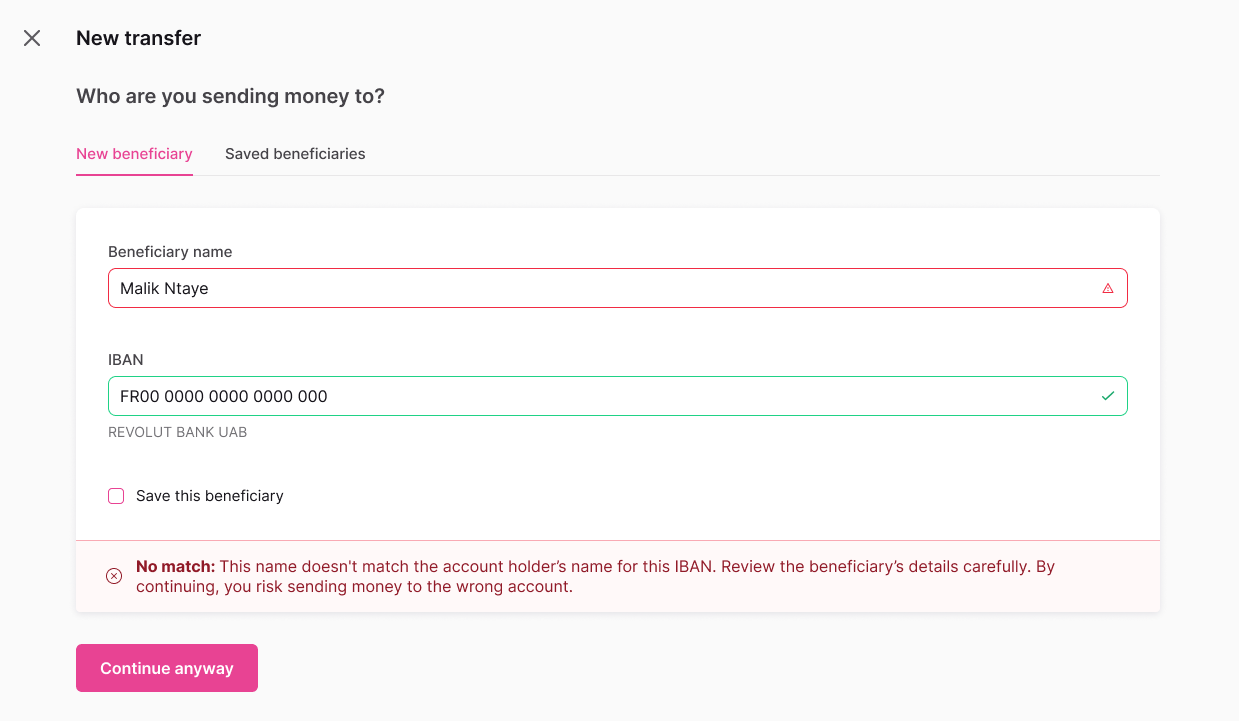

Result: No match found between provided details and account holder information

End-user action: Verify beneficiary details carefully before proceeding

Mobile consent screen:

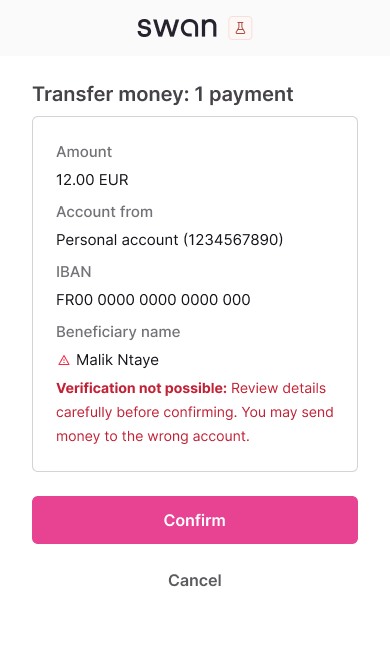

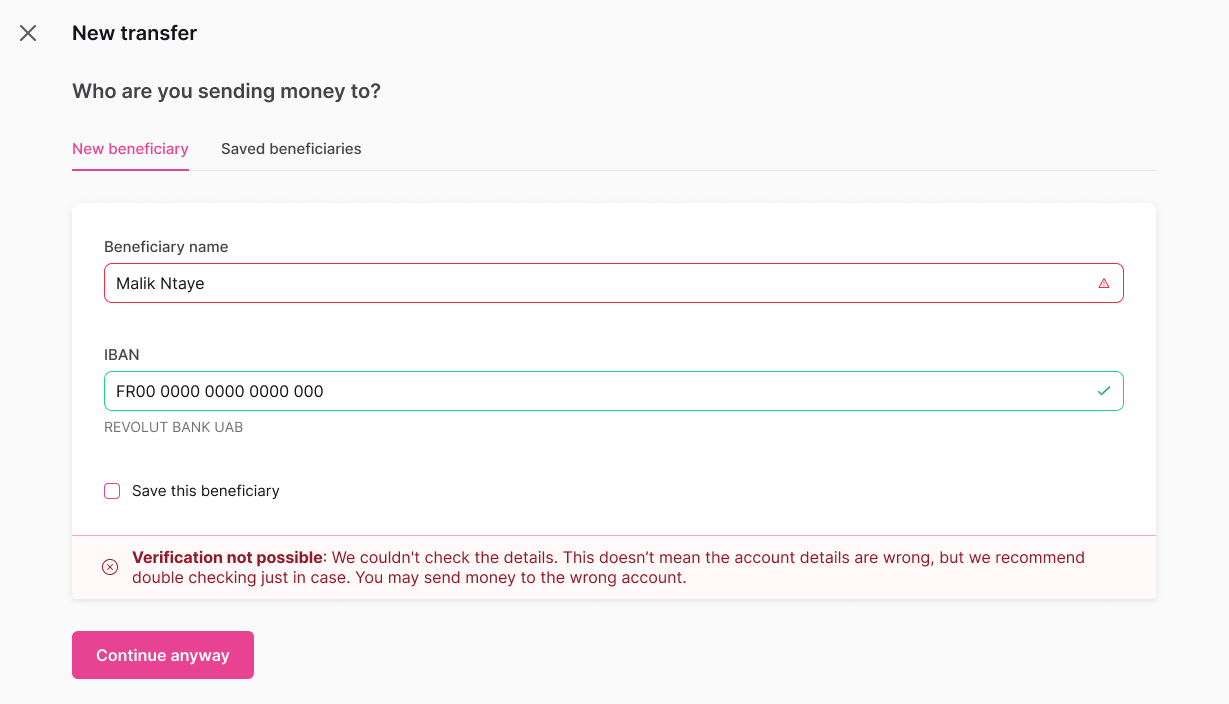

Result: IBAN verification failed. Check the IBAN format, try again, or contact the recipient's bank if the issue persists.

End-user action: Verify beneficiary details carefully before proceeding

Mobile consent screen:

Verification of Payee provides verification results so end-users can make informed decisions, but doesn't block payments from proceeding.

Standing Orders

VoP applies to Standing Orders with two key differences:

- Initial verification only: VoP happens at the initiation stage when creating the Standing Order

- Existing Standing Orders: Previously authorized Standing Orders don't need to be verified - only new Standing Orders created on or after October 9, 2025, will require VoP

Bulk payments

Company accounts can opt-out of receiving VoP on their bulk SEPA credit transfers through a dedicated upcoming mutation.

Integration flows for VoP

Swan provides two integration options based on your user experience (UX) needs and development limitations to ensure a compliant integration.

🟡 Option 1: Default verification

Swan automatically verifies beneficiary details when the end-user initiates a credit transfer

- No additional development required for single SEPA Credit Transfers.

- Swan displays VoP results and warnings in the consent screen.

- Best for: Quick compliance and existing integrations.

🟢 Option 2: Custom verification

Swan verifies beneficiary details on-demand using the verifyBeneficiary mutation

- Complete control over VoP results presentation.

- Custom error handling and user guidance.

- Best for: Enhanced UX and bulk payment flows.

Supported payment types

| Payment Type | 🟡 Option 1: Default | 🟢 Option 2: Custom | VoP requirements |

|---|---|---|---|

| Single Credit Transfers | ✅ Supported | ✅ Supported | Required |

| Bulk Credit Transfers | ❌ Not Supported | ✅ Supported | Opt-out available for company accounts |

| Standing Orders | ✅ Supported | ✅ Supported | Required in the initiation stage |

Option 1: Default verification

For single credit transfers, you don't have to do anything - Swan will run the VoP check at the initiation of the credit transfer and display the VoP result in the consent screen.

Option 1 is not available for Bulk Credit Transfers. For bulk credit transfers, use Option 2 or if you have company end-users, opt-out of VoP using the dedicated mutation.

Option 2: Custom verification

Call the verifyBeneficiary mutation before initiating SEPA Credit Transfers to get full control over the verification user experience.

Verification flow

- Verify beneficiary: Call the

verifyBeneficiarymutation using an IBAN and account holder name. - Receive the verification result: Match, Close match, No Match, or Verification not possible. A unique token is also returned, identifying the VoP and result.

- Inform the end-user: Display appropriate messaging and optional actions based on the verification result.

- User proceeds: The end-user can choose to proceed with the payment regardless of the result.

- Use token: Add the beneficiary token to the input of the initiateCreditTransfers mutation.

- User gives consent: Complete the payment authorization.

Detailed verification flow diagram

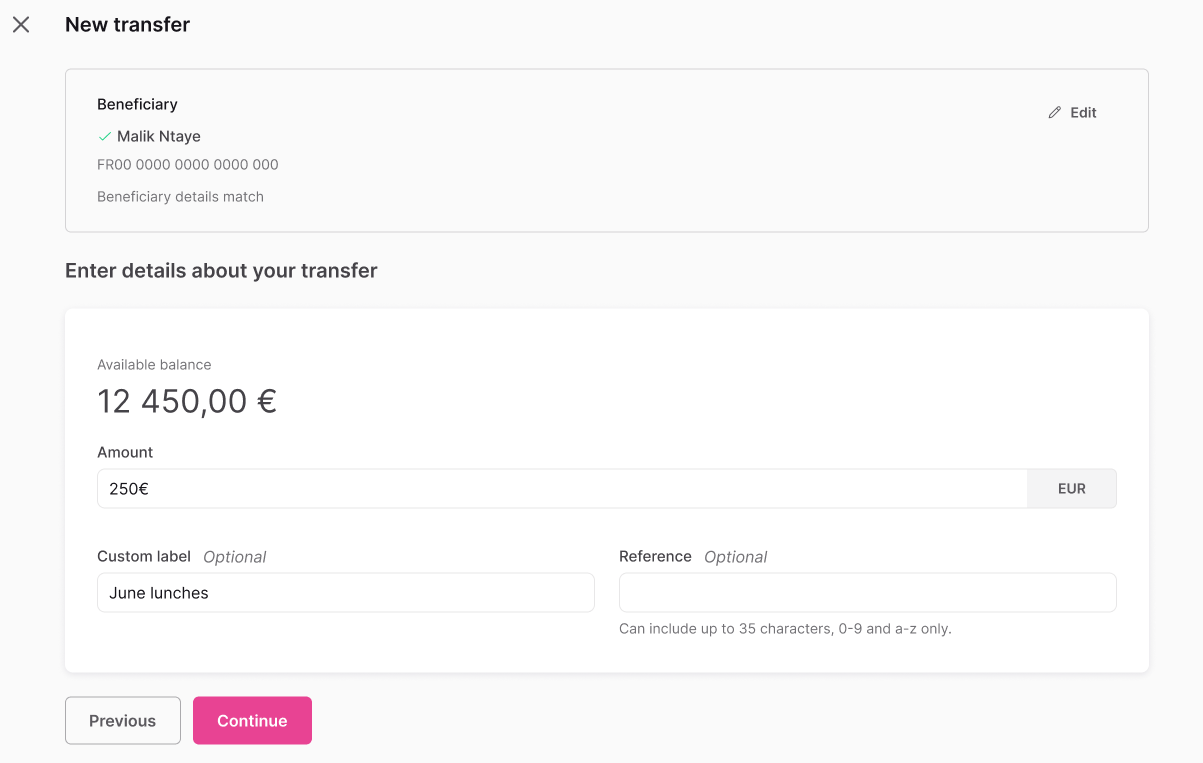

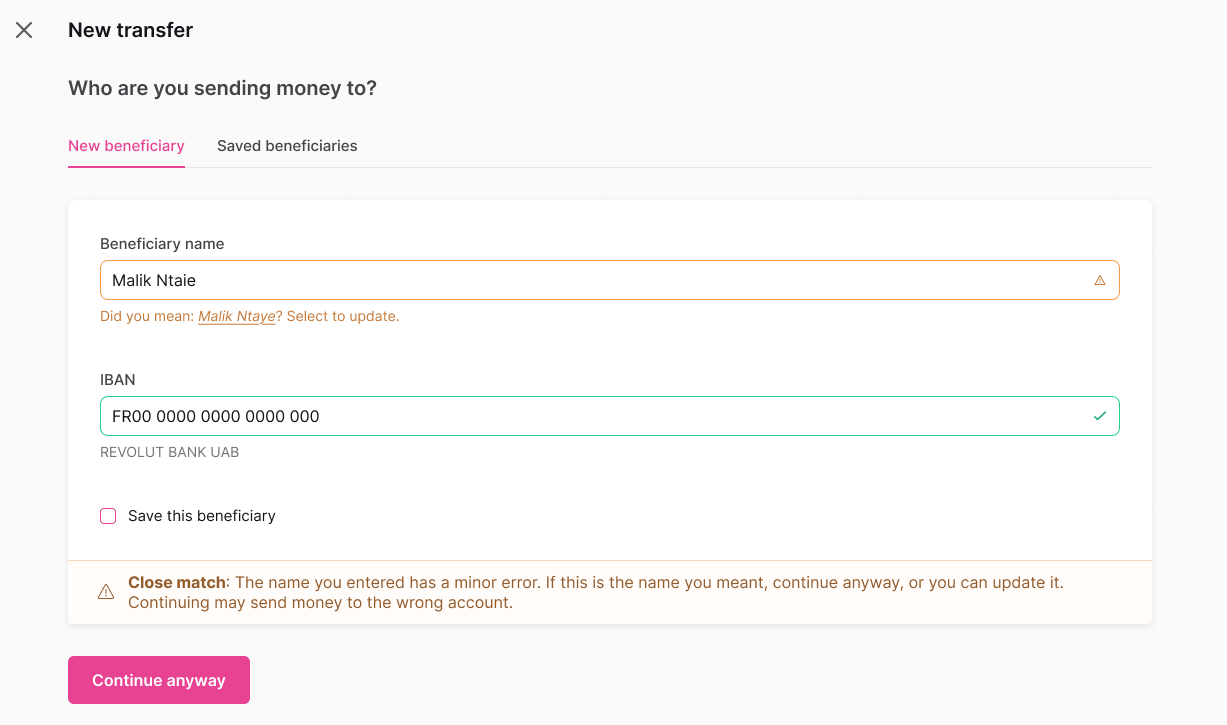

Custom UX examples

Examples of how to present VoP verification results in your web banking interface during the "Custom UX handling" step.

- ✅ Match

- ⚠️ Close match

- ❌ No match

- ❌ Verification not possible

Coming soon

The following features are under development. Final implementation may differ.

Complete API documentation

Full specifications for VoP mutations and updated endpoints will be provided, including:

verifyBeneficiarymutation: Pre-validate beneficiary details before payment initiation- Updated

initiateCreditTransfersmutation: Support for beneficiary tokens and VoP compliance - Verification result types: Match, Close match, No match, and Verification not possible responses

Enhanced integration options

- Server-to-Server consent with VoP: Handle verification results in S2S consent flows

- Bulk credit transfers management: Opt-out and opt-in capabilities for company accounts

- Trusted beneficiaries integration: VoP compatibility with Swan's trusted beneficiary system