International Credit Transfers

Overview

Send and receive money almost anywhere in the world using a Swan International Credit Transfer.

With Swan International Credit Transfers, you can:

Exchange euros for a different currency, then transfer that money on either local rails or the SWIFT network.

- Transfer euros outside of the eurozone using the SWIFT network.

- Receive credit transfers initiated outside of the eurozone. You'll receive these transfers in euros as Swan doesn't store money in currency other than euros.

International Credit Transfers follow the standard credit transfer status flow with one exception: they can't have the status Upcoming.

Risk with international transfers

International transfers can introduce more significant risk than transfers that don't cross borders or change currencies. Additionally, since more legal jurisdictions are involved, Swan International Credit Transfers must follow regulations for multiple regions.

Potential areas for increased risk and friction include: instability in the target region, diverging requirements for consent or identity documents, different reactions in the case of disputed transactions, fluctuation in currency value and exchange rate, and more.

Therefore, Swan prioritizes a risk-based approach, which applies to you and your end users. In addition to increased scrutiny in the transaction-review process, both automated and manual, Swan uses dynamic forms in the International Credit Transfer API.

Outgoing allowed countries

Your users can send International Credit Transfers on local rails in local currencies.

They can also send International Credit Transfers on the SWIFT network swift_code using United States Dollars USD, Euros EUR, or Great British Pounds GBP.

Any attempt to send a SWIFT transfer in other currencies is rejected.

Allowed countries and rails

Fees

There are fees for executing international transfers according to the non-euro currency selected.

Each eligible currency is assigned to a fee group, numbered 1 through 4. Swan determined the groups based on how much it costs to execute a transfer with that currency. For example, it costs less to execute a transfer between euros and a currency in fee group 1 than with a currency in fee group 3. The lists of allowed countries for outgoing transfers include each currency's fee group.

The fees listed on this page are always paid by the Swan user.

| Fee group | Outgoing transfer fee ∗ | Incoming transfer fee ∗∗ |

|---|---|---|

| Group 1 | 5€ + 0.6% | 5€ (+ 0.6%) |

| Group 2 | 5€ + 1% | 5€ (+ 1%) |

| Group 3 | 5€ + 2% | 5€ (+ 2%) |

| Group 4 | 5€ + 5% | 5€ (+ 5%) |

∗ For outgoing transfers, an additional 5€ fee is charged when sending USD, GBP, and EUR through SWIFT. For these currencies, the total fee is 10€ + the percentage % indicated in the table.

∗∗ For incoming transfers, the additional fee percentage (in parentheses) only applies to transfers not already converted into euros.

Fees are charged in their own transaction. Therefore, each International Credit Transfer creates two transactions on your transaction history: one for the transfer and one for fees. Fees and transfer transactions are created, booked, and rejected simultaneously. Both transactions have the same status.

This section shares Swan's standard pricing, which might vary based on your contract.

Outgoing transfers

Payment rails

Initiate transfers using one of two payment rails: local or SWIFT. Choose your rail when declaring your beneficiary.

| Payment rail | Description | Benefit |

|---|---|---|

| Local bank transfers |

| Faster, less expensive |

| SWIFT network |

| Wider availability |

Currency exchange

Transferring money internationally requires currency exchange. Think of currency exchange as the cost of selling one currency to purchase another.

Currency exchange is always charged for outgoing transfers.

Swan uses a mid-market rate, or the midpoint between the buy and sell prices for the two currencies involved in a transfer, with no added spread.

For outgoing International Credit Transfers, the exchangeRate is determined when a transfer is initiated.

After initiating the transfer, the exchange rate is locked for one business day, even if the market rate changes. During this time, users must provide consent to execute the transfer. If the day passes without consent, Swan no longer guarantees the exchange rate. Therefore, the transfer will be rejected and the user would need to initiate a new transfer.

Find the exchange rate, as well as fees, in the success payload of the initiateInternationalCreditTransfer mutation, as well as when consenting to the transfer.

Transfer limits

A maximum transaction limit of €100,000.00 (one hundred thousand euros) applies to all outgoing International Credit Transfers. The payment rail used or currency exchange doesn't impact the maximum transaction limit.

All outgoing International Credit Transfer exceeding €100,000.00 will be rejected.

Outgoing transaction statuses

Outgoing International Credit Transfers cycle through three possible transaction statuses.

| Status | Explanation |

|---|---|

Pending | Status assigned when the transfer is initiated; the transfer retains the status Pending while the transactions associated with the transfer follow the standard transaction status flow |

Booked | Funds arrived in the beneficiary's account |

Rejected | Transfer isn't executed for any of several reasons, including insufficient funds, lack of consent, and more |

Rejected transactions

An outgoing International Credit Transfer might be rejected for several reasons, including:

- The transfer exceeds the maximum transaction amount limit.

- Some of the account or bank details are incorrect.

- The account is closed.

- A required mandate was never provided.

However, a common reason for all rejections is insufficient funds.

For all outgoing International Credit Transfers, Swan checks the account balance to make sure there is enough money to cover both the transfer amount and the fees. If there isn't enough money in the account to cover both the transfer amount and the fees, the transfer will be rejected for insufficient funds.

If a transfer is rejected, fees aren't charged. If a transfer is returned, fees are also refunded.

Outgoing sequence diagram

API dynamic forms

Swan's outgoing International Credit Transfer API uses dynamic forms.

Dynamic forms mean that the information requested changes based on the information you submit in each query. For example, the required information will be different for a beneficiary in India than for a beneficiary in the UK.

Integrating dynamic forms

Dynamic forms make this feature more challenging to integrate for your custom integrations.

In your integration, you should only request the most basic information per query, as shown in the API Explorer. Specific logic is then required to retrieve the correct key/value pairs according to the information submitted in the dynamic fields.

The concept of refreshable dynamic fields is illustrated in the guide to get beneficiary information.

Dynamic forms allow Swan to collect only required information from your end users, collected in the format of key/value pairs. Some locations require a few key/value pairs while others might require 10 or more.

Since the required information changes frequently and is outside of Swan's control, dynamic forms provide the best way to only collect the correct information, which also minimizes risk and ensures secure transactions.

Query and mutation order

Due to these dynamic forms, it's critical to run the queries in order before running the mutation.

- Optionally, get a quote.

- This query provides a quote for the exchange rate and fees.

- The quote isn't guaranteed.

- Next, get the list of required key/value pairs for your beneficiary.

- They're based on the target currency and the beneficiary's country of residence.

- Then, get the list of required key/value pairs for your transaction.

- They're based on the transfer's destination.

- Finally, initiate your transfer.

Incoming transfers

Debtors can send credit transfers to Swan accounts, regardless of the debtor's account currency. Swan's existing Bank Identifier Codes (BICs) are connected to SWIFT, so Swan users don't need an additional IBAN to receive SWIFT transfers.

Swan and intermediary bank details for incoming transfers

Standard flow

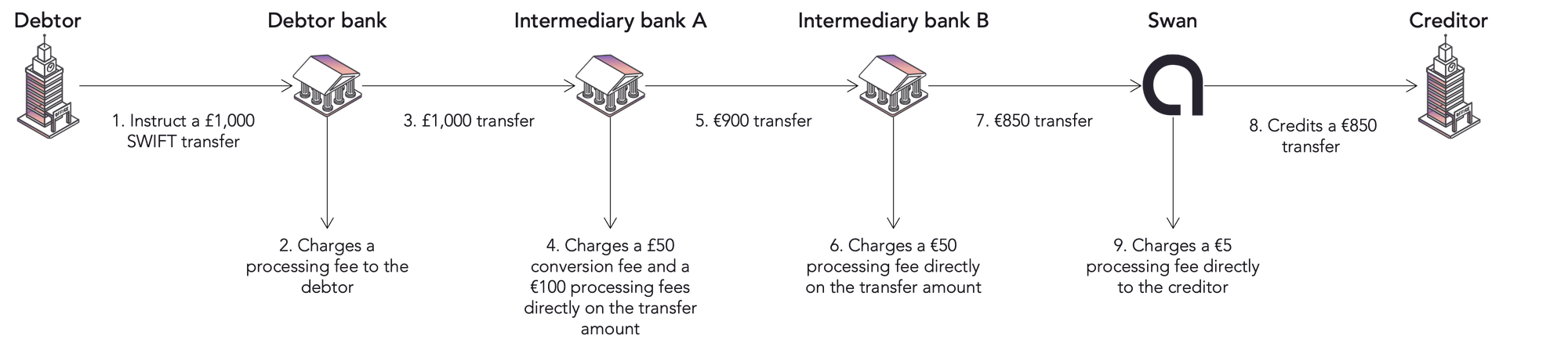

Consider the following image:

- Debtor initiates a transfer of £1,000 (GBP) to a Swan account.

- Debtor's bank charges them a processing fee.

- Debtor's bank then passes the £1,000 to a first intermediary bank.

- Swan only has euro-based accounts, so intermediary bank A converts the transfer from GBP to EUR.

- They charge a £50 fee to convert the currency.

- They charge an additional €100 (EUR) processing fee.

- Since the transfer was initiated with shared fees, intermediary bank A deducts their fees directly from the transfer amount.

- Intermediary bank A then passes the transfer on to a second intermediary bank.

- After the conversion and the fee deduction, €900 remains.

- Intermediary bank B charges a €50 processing fee and deducts it from the transfer amount.

- Intermediary bank B passes the transfer on to Swan.

- After the conversion and the fee deduction, €850 remains.

- Swan books the incoming SWIFT transfer's remaining amount (€850) immediately to the Swan user's account.

- Swan charges a €5 processing fee separately from the transfer.

SWIFT details

Incoming International Credit Transfers sent on SWIFT can be sent with one of the following specifications:

SHA: Splits fees between the debtor and their beneficiary. For instance, the payer might pay the fees charged by their bank and the beneficiary might pay the intermediary banks fees. The standard flow example usesSHA.BEN: All fees paid by the beneficiary by deducting them from the transaction amount.OUR: All fees paid by the debtor. Some banks might not respect this, though, so it’s possible to receive an intermediary bank fee as a beneficiary anyway.

Booked transfers

When Swan receives an incoming International Credit Transfer, Swan books it immediately and creates a InternationalCreditTransferTransaction type (step 8 in the standard flow described).

Use the transactions query with the ID for your International Credit Transfer to get information.

Notifications

You can use the Transaction.Booked webhook to be notified any time a transaction is created.

{

"eventDate": "2023-11-22T14:25:32.133Z",

"eventId": $WEBHOOK_EVENT_ID,

"eventType": "Transaction.Booked",

"projectId": $YOUR_PROJECT_ID,

"secret": null,

"resourceId": $INCOMING_TRANSACTION_ID,

"retryCount": 0

}

Currency exchange

Transferring money internationally requires currency exchange. Think of currency exchange as the cost of selling one currency to purchase another.

For incoming transfers, you can view the exchangeRate in the InternationalCreditTransferTransaction type, created when the transaction is booked.

Other currency exchange information isn't available for incoming transfers.

Typically, incoming transfers arrive in euros. If Swan performs the currency exchange, the additional fees in parentheses listed in the fees table for incoming transfers are charged. For example, if Swan receives a transfer in United States Dollars, 0.6% of the received amount is charged along with the standard €5 fee.

Guides

- Outgoing transfers

- Get information about a transfer

- Add a trusted international beneficiary

- Sandbox, including how to simulate receiving an incoming International Credit Transfer