Build a compliant billing offer

Build a compliant billing offer, charging qualified fees to your end users with or without customization.

You can customize certain banking fees to adapt your billing offer to your product and user type. Learn more about customizing your offer at the end of this page.

Overview

All banking fees are legally framed and supervised by a regulator. In France, the regulator is the Autorité de Contrôle Prudentiel et de Résolution. Some fees are capped or forbidden because they are considered abusive, depending on the account holder's status. Therefore, only regulated entities can bill banking fees because they're subject to the regulator's supervision.

Swan Partners aren't acting as regulated financial entities, so you can't bill directly for banking fees—even if your product provides support associated with these fees. In other words, you can't include banking fees in your pricing offer as fees you charge your users.

If the product you've built brings value (for example, in the preparation of payment orders), you're authorized to bill for this functionality under the appropriate denomination. In order to do so, your product must add value for your client.

Swan must verify your billing offer, whether standard or customized, regarding the payment-related options before you go live to confirm you aren't billing for unauthorized fees.

Authorizations

- You can charge your customers for all the functionalities not considered banking fees.

- If your product improves or eases the preparation of payment orders, you can bill that function directly.

- You can present the functionalities considered as banking fees to your customers.

Restrictions

- You can't charge your customers for banking-related fees. For example, you can't charge fees for opening an account, scheduling a payment, or using a card.

- You can't present your offer with wording reserved by law to the banking and payment services bill. The banking fee descriptions are harmonized by law to help all users understand them clearly. Using this wording is exclusively dedicated to the presentation of banking fees.

Your product helps detect the amount to be paid, the execution date, and the counterparts of an operation. It fills out the payment order to be sent by your customer.

- ✓ You can bill for the functionalities of detecting the data and filling out the payment order.

- ✗ You can't bill for the execution of the payment order itself, or for the opening of the account.

Fees

✓ Billable fees

Some fees aren't classified as banking fees. As a Swan Partner, you can bill for the following fees:

- Fees connected to collecting debts.

- Preparation of payment orders.

- Fee for shipping a debit card.

- Improper use of the account.

✗ Non-billable fees

Many fees are classified as banking fees and are therefore non-billable. As a Swan Partner, you can't bill for the following fees.

| Category | Fee |

|---|---|

| Accounts |

|

| Cards |

|

| Credit transfers |

|

| Direct debits |

|

| Subscription |

|

| Other |

|

| Incident fees (also classified as banking fees) |

|

Customizing your offer

As a Swan Partner, you decide whether to pay all the banking fees related to your users' operations, or to let Swan charge your users directly.

Swan is always the entity charging the fees—you never charge these banking fees directly.

By default, Swan's banking fees are charged according to the following table. All fees charged to you could be charged to your users instead with a customized billing offer. Please note that you are ultimately responsible for any outstanding payments owed by your users.

| Fees charged to | Fee |

|---|---|

| Swan Partners (you) |

|

| Account holders (your users) |

|

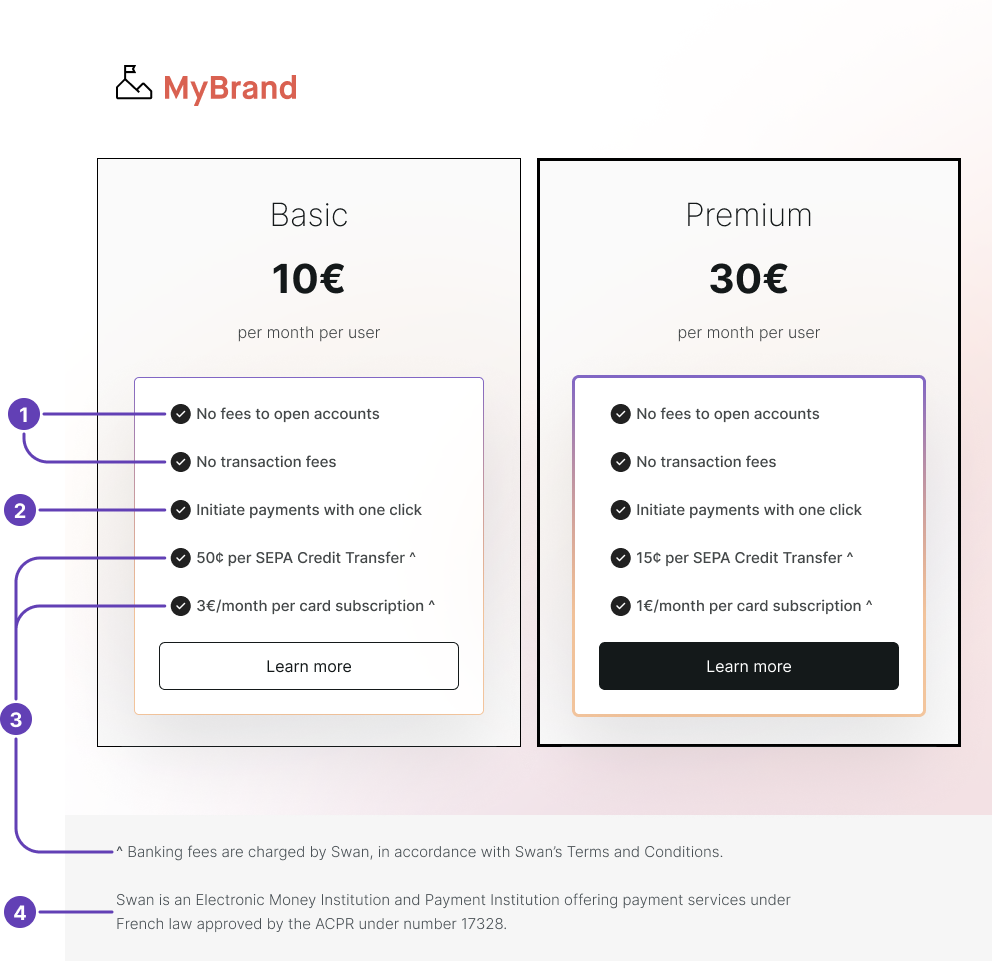

Presenting your customized offer

How you present your customized billing offer must respect certain guidelines.

Your pricing offer must be transparent to your users, allowing them to compare pricing for various payment products on the market.

- If you decide to cover your users' fees, you can mention it.

- For example, you might say No fees to open accounts or No transaction fees.

- If your product helps prepare payment orders, you can mention it.

- For example, you might say Initiate payments with one click.

- If you choose to mention Swan's banking fees, you must indicated that fees are charged by Swan.

- For example, you could add a symbol (^) referring the user to the following information somewhere on the offer page: Fees charged by Swan, according to Swan's Terms and Conditions.

- If Swan's fees are mentioned, the following information about Swan must be included in the footer of your offer page: Swan is an Electronic Money institution and Payment institution offering payment services under French law approved by the ACPR under number 17328.

Fee labels, meaning how fees are displayed to account holders on Web Banking, transaction histories, and account statements, aren't customizable. When customizing your offer, you must keep Swan's standardized wording; you can't change fee wording when presenting your offer.

Please refer to your most recent Swan Terms and Conditions for standardized fee wording.