Rules and regulations

In partnering with Swan, you agree to a set of requirements. This means you must respect certain obligations and restrictions, and you also have plenty of capabilities. In other words, there are certain things you must do and you can't do, and also plenty of things you can do.

Must → Partner obligations

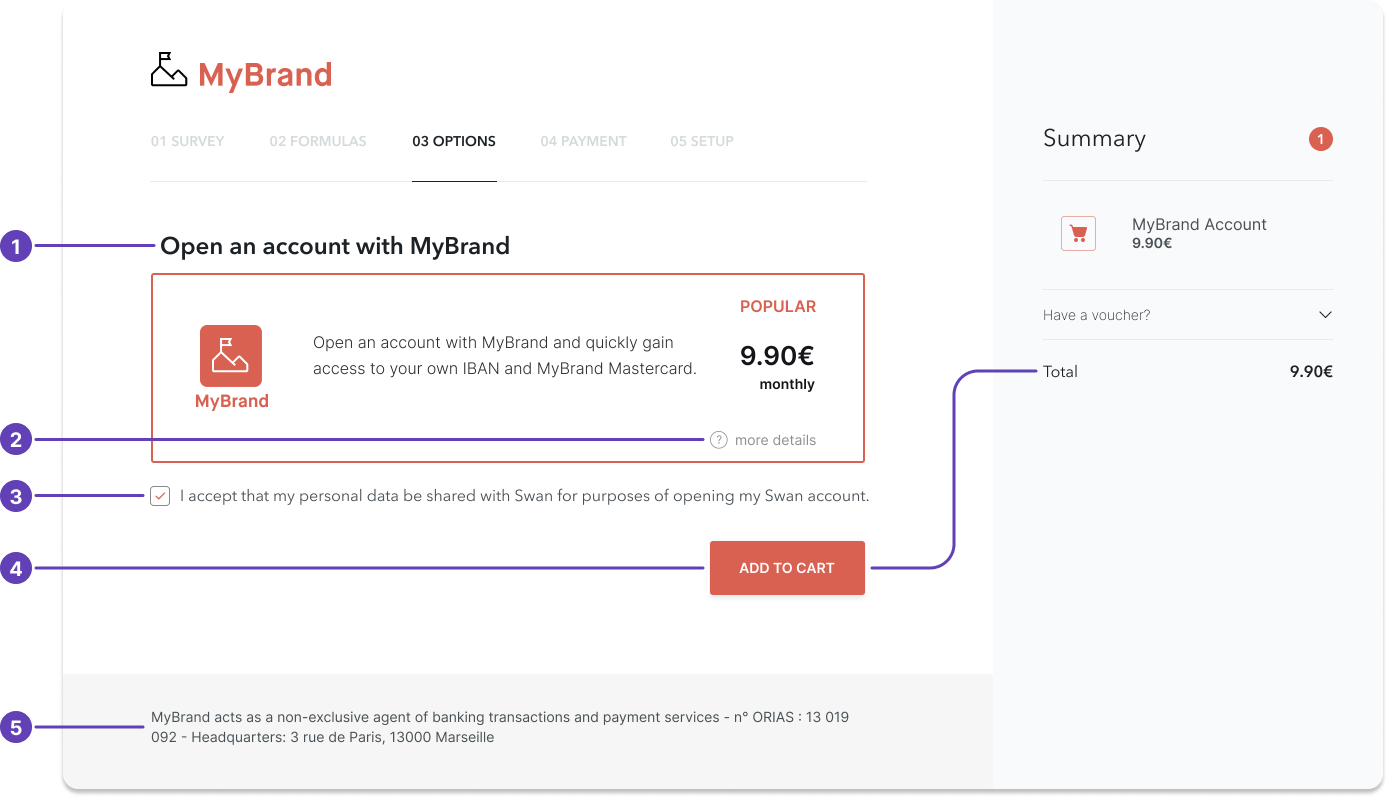

As a Swan Partner, you are allowed to sell and present Swan's commercial offer as your own, without any obligation to mention Swan.

You must, however, comply with data protection regulations. Communicate the following information to your users:

- Provide a company privacy policy.

- Tell your users that their data will be shared with Swan.

- Share your company's legal status. Provide the following information in your footer and legal notices:

- Your company's legal status

- If in France, your Orias registration number

- Legal name as provided on your official paperwork

- Postal address

Can't → Partner restrictions

As a Swan Partner, you can't do the following:

- You can't manage sensitive operations yourself (for example, Strong Customer Authentication), although you may participate in collecting required documentation.

- Regulations stipulate that companies with your legal status can't call yourselves banks or neobanks.

- You can't sell payment services. Only Swan is allowed to sell payment services.

- You can't call your offer a “bank account”. You may, however, use the wording "payment account". Please make sure not to choose wording that suggests you are the entity providing payment accounts because that's Swan's responsibility. Consider the following naming suggestions:

MyBrand AccountMyBrand PremiumMyBrand Wallet

Can → Partner capabilities

As a Swan Partner, you can:

- Present payment services directly on your platform. You don't have to route your users to Swan.

- Provide access to your own platform, app, or SaaS, where users can manage their Swan accounts, prepare payment orders, and more.

- White-label the branding. You can brand Swan's payment services as your own. Make sure to mention Swan as a partner in your Terms and Conditions.

- Present Swan's Terms and Conditions and commercial offer within your own Terms and Conditions, or directly on your website.

- Collect client information and identification documents yourself (for example, proof of address, company registration), then forward them to Swan. Make sure to share this intention in your GDPR notice to your clients.

How to present your offer

- You can brand banking services entirely as your own, without having to mention Swan as a partner. (Note that if the product seems unclear about which entity is regulated, you might be asked to mention Swan.)

- You can provide details of banking services on your own website.

- The example provides a correct mention of data protection policies.

- You can offer banking services directly on your platform.

- The example provides a correct way to declare that you are a Registered Swan Intermediary.

To learn about how Swan handles fees and your options to charge your users, refer to the guide to build a compliant billing offer.

Restricted businesses

Swan builds infrastructure for businesses to embed financial services. Most types of companies can embed banking services with Swan, but some aren't allowed. Swan must also follow all local laws and rules from banks, payment networks, and regulators.

This decision is risk-based, not preference-based. Swan won't work with industries that could harm the reputation or finances of Swan or its partners.

Restricted activities are categorized into two groups:

- Common Restricted Activities: This list applies to all Swan Partners. Your users can access this list in our dedicated Support Center article.

- Additional Restricted Activities: These apply only to Partners with specific regulated services, such as Neobanks, Accounts Payable, and Capital deposits. Please contact your PIM (Partner Integration Manager) to confirm if these apply to your service.

Businesses engaged in activities listed in either group will be ineligible to open an account.

Common restricted activities

Swan restricts activities in the following list for all users:

| Category | Restricted activities |

|---|---|

| Financial and regulatory risk activities |

|

| Crypto-assets and virtual currencies |

|

| Controversial or sensitive activities |

|

| Substance and materials-related activities |

|

| High-risk or unregulated commerce |

|

Additional restricted activities

Swan restricts activities in the following list for users of Swan Partners supporting specific regulated use cases.

If these restrictions affect your project, we recommend that you include both the common and additional lists of restricted activities in your own terms and conditions or support documentation, and share this list with your users.

| Category | Restricted activities |

|---|---|

| Tobacco and related industries |

|

| Extractive and high-impact energy industries |

|

| Industrial and chemical activities |

|

| Gaming, gambling, and entertainment with monetary value |

|

| Financial and payment-related services |

|

Not participating in one of the listed industries doesn't mean your account will be validated. All Swan Partners complete a rigorous review process before going Live. Learn more in the guide to activate a Swan project.